Customer behavior has become increasingly complex as digital interactions multiply and expectations for personalized experiences rise across all industries. Traditional analytics that report on past performance provide limited value when businesses need to anticipate future customer actions and market opportunities.

Predictive customer analytics addresses this challenge by using advanced algorithms and machine learning to identify patterns in customer data that indicate future behavior, preferences, and business value potential. This approach enables organizations to move from reactive customer management to proactive strategies that prevent churn, increase lifetime value, and create competitive differentiation.

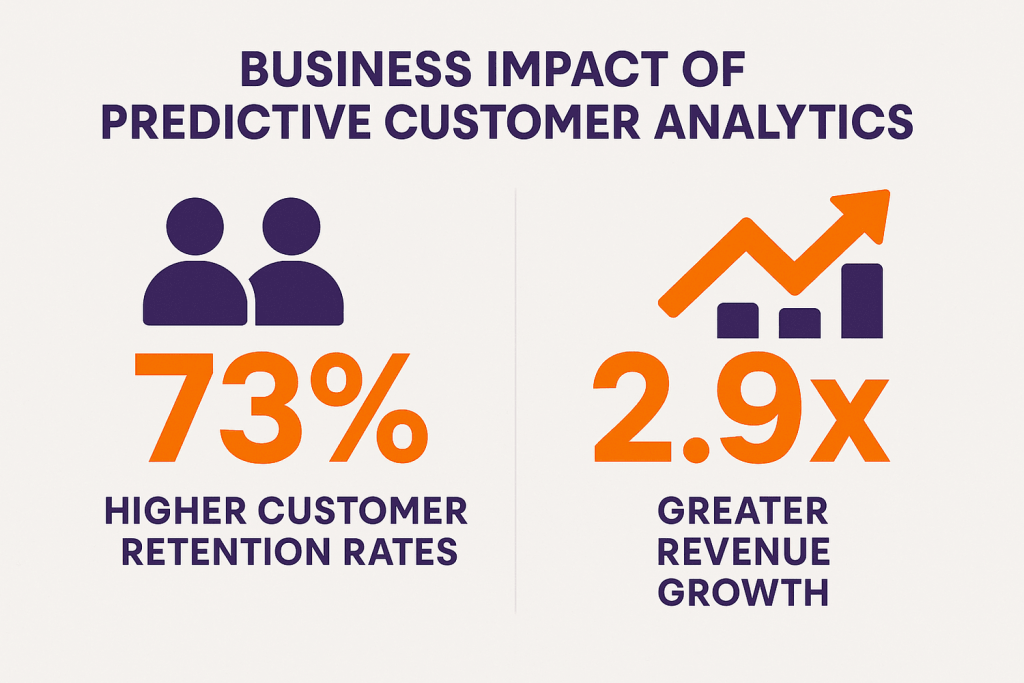

The business impact is significant. Companies using predictive customer analytics report 73% higher customer retention rates and 2.9 times greater revenue growth compared to organizations relying on traditional reporting methods, according to research. This performance advantage stems from the ability to make data-driven decisions about resource allocation, marketing investments, and customer experience improvements.

This analysis examines how predictive customer analytics works, its key benefits and limitations, and practical implementation strategies that enable organizations to transform customer data into strategic business intelligence.

What Is Predictive Customer Analytics?

Predictive customer analytics uses statistical modeling, machine learning algorithms, and historical customer data to forecast future customer behaviors, preferences, and business outcomes with measurable accuracy.

Unlike descriptive analytics that explain what happened in the past, predictive analytics identifies patterns and relationships in customer data that indicate probable future actions. These insights enable businesses to anticipate customer needs, prevent negative outcomes, and optimize resource allocation based on predicted customer value and behavior.

The approach combines multiple data sources including transaction history, interaction records, demographic information, and behavioral patterns to create comprehensive customer profiles that support accurate predictions about purchase likelihood, churn probability, and response to marketing campaigns.

Modern predictive customer analytics platforms can process millions of customer records in real-time, updating predictions as new data becomes available and enabling dynamic customer management strategies that adapt to changing conditions and preferences.

What Are the Core Components of Predictive Customer Analytics?

Successful predictive customer analytics depends on three fundamental components that work together to transform raw customer data into actionable business intelligence.

Data Collection

A well-defined customer data strategy ensures that comprehensive data collection forms the foundation for accurate predictive models by capturing customer interactions, behaviors, and characteristics across all touchpoints and channels.

Effective data collection strategies include transaction records, website behavior, mobile app usage, customer service interactions, social media activity, demographic information, and external data sources like market trends or economic indicators that influence customer behavior.

The quality and completeness of collected data directly impacts prediction accuracy. Data integration techniques become critical as customer information exists across multiple systems including CRM platforms, e-commerce systems, support tools, and marketing automation platforms. Unified customer profiles require sophisticated data integration and normalization processes.

Data Analysis

Advanced analytics techniques identify meaningful patterns, relationships, and segments within customer data that traditional reporting methods cannot detect or quantify effectively.

Statistical analysis reveals correlations between customer characteristics and behaviors that indicate future actions. For example, analysis might show that customers who interact with support within the first 30 days have 40% higher lifetime value than those who don’t engage early.

Machine learning algorithms can process vast amounts of customer data to identify complex patterns that human analysts would miss. These algorithms continuously improve their pattern recognition as they process more data, creating increasingly accurate insights over time.

Segmentation analysis groups customers with similar characteristics and behaviors, enabling targeted predictions and personalized strategies for different customer types rather than generic approaches.

A well-structured data analytics framework ensures these methods work cohesively, turning raw data into actionable insights that drive smarter business decisions.

Predictive Modeling

Predictive analytics techniques and mathematical algorithms use mathematical algorithms to forecast specific customer outcomes based on historical patterns and current customer characteristics with quantifiable confidence levels. Common predictive models include churn prediction models that identify customers likely to cancel services, lifetime value models that estimate future revenue potential, and propensity models that predict likelihood of specific actions like purchases or upgrades.

Model validation ensures prediction accuracy through testing against historical data and ongoing performance monitoring. Accurate models typically achieve 75-90% prediction accuracy depending on data quality and business complexity. Model deployment integrates predictions into business processes through automated triggers, dashboards, and API connections that enable real-time decision making based on customer behavior predictions.

How Does AI Power Predictive Customer Analytics?

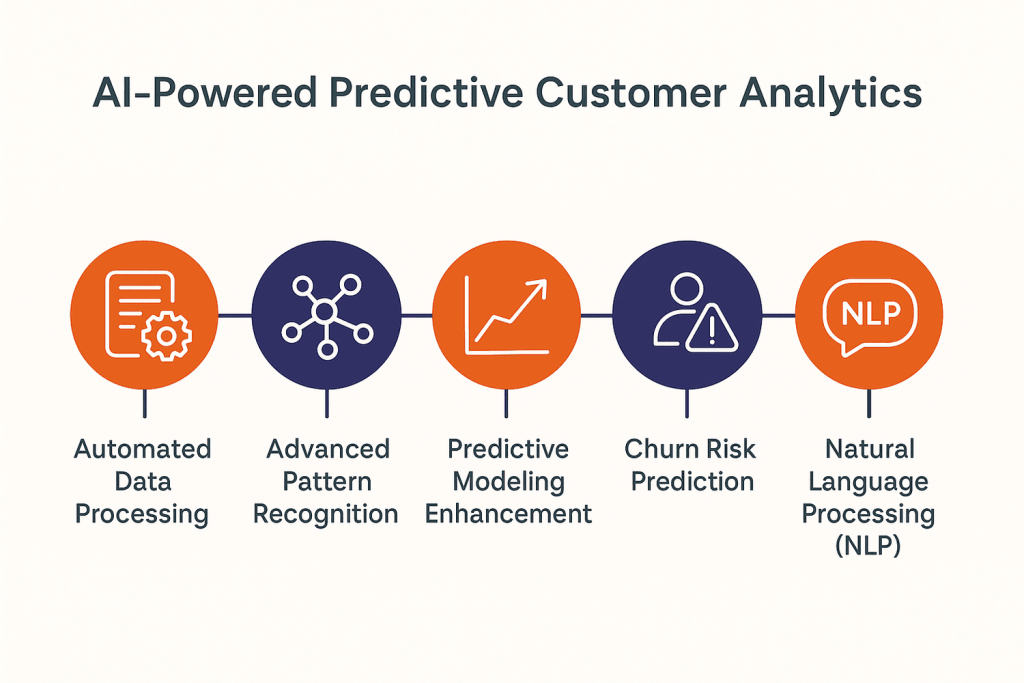

Artificial intelligence technologies enable predictive customer analytics capabilities that exceed traditional statistical approaches in accuracy, scale, and real-time processing ability. Here how it works:

Automated Data Processing

AI customer analytics systems automatically collect, clean, and integrate customer data from multiple sources without manual intervention, enabling real-time analytics that keep pace with rapidly changing customer behaviors.

Machine learning algorithms can identify and correct data quality issues, fill gaps in customer records, and standardize information formats across different systems. This automation reduces data preparation time from weeks to hours while improving accuracy.

Automated processing also handles the scale requirements of modern customer analytics, processing millions of customer records and interactions daily while maintaining performance standards that support real-time business applications.

Advanced Pattern Recognition

AI algorithms identify complex patterns in customer behavior that traditional statistical methods cannot detect, revealing insights about customer preferences, decision-making processes, and response patterns.

Deep learning models can analyze unstructured data like customer emails, chat transcripts, and social media posts to extract sentiment, intent, and satisfaction indicators that complement structured transaction data.

Pattern recognition capabilities enable discovery of previously unknown customer segments, unexpected behavior correlations, and emerging trends that inform strategic business decisions about product development and market opportunities.

Predictive Modeling Enhancement

AI improves predictive model accuracy through ensemble methods that combine multiple algorithms, automatic feature selection, and continuous learning that adapts models based on new data and changing conditions.

Neural networks and gradient boosting algorithms often achieve 15-25% higher prediction accuracy compared to traditional regression models, particularly for complex customer behaviors with multiple influencing factors.

AutoML platforms enable organizations to build sophisticated predictive models without extensive data science expertise, democratizing access to advanced analytics capabilities while maintaining enterprise-grade accuracy and reliability.

The rise of generative AI for data analytics further enhances this area by automatically creating synthetic datasets, enriching feature engineering, and accelerating model experimentation to improve prediction quality.

Churn Risk Prediction

AI-powered churn prediction models analyze customer behavior patterns, engagement trends, and satisfaction indicators to identify customers at risk of cancellation with 85-95% accuracy.

These models leverage big data predictive analytics by considering hundreds of variables simultaneously, including usage patterns, payment history, support interactions, and comparative behavior against similar customers who have churned in the past.

Early warning systems triggered by churn predictions enable proactive retention efforts that are 5-7 times more cost-effective than reactive win-back campaigns after customers have already decided to leave.

Natural Language Processing (NLP)

NLP capabilities analyze customer communications, feedback, and social media mentions to extract sentiment, intent, and satisfaction insights that enhance predictive model accuracy and business understanding.

Advanced NLP can identify specific customer concerns, preferences, and satisfaction drivers from unstructured text data, providing context that quantitative data alone cannot capture.

Real-time sentiment analysis enables immediate response to customer satisfaction changes, preventing issues from escalating to churn while identifying opportunities for proactive customer success interventions.

Leverage AI-driven analytics to reduce churn and boost loyalty.

What Are the Key Benefits of Predictive Customer Analytics?

The strategic value of predictive customer analytics extends across multiple business functions, creating competitive advantages that compound over time.

Improved Customer Segmentation

AI-powered segmentation identifies customer groups based on behavior patterns, preferences, and predicted value rather than simple demographic characteristics, enabling more effective targeting and personalization strategies.

Advanced segmentation might reveal that customers who make their first purchase during specific times of year have 30% higher lifetime value, or that customers with certain interaction patterns are 5 times more likely to become brand advocates, according to studies.

Dynamic segmentation updates customer classifications as behavior patterns change, ensuring that marketing and service strategies remain relevant and effective as customer needs evolve.

Behavioral segmentation enables micro-targeting that increases campaign response rates by 40-60% compared to demographic-based approaches while reducing marketing waste and improving customer experience relevance.

Enhanced Personalization

Predictive analytics enable mass personalization by forecasting individual customer preferences, optimal communication timing, and preferred product categories with accuracy that supports automated personalization at scale. Personalization based on predictive insights increases conversion rates while improving customer satisfaction scores through comprehensive customer experience analytics.

Real-time personalization adjusts website content, product recommendations, and marketing messages based on current customer behavior and predicted preferences, creating dynamic experiences that adapt to individual needs. Advanced personalization considers not just what customers might want, but when they’re most likely to engage, which communication channels they prefer, and what messaging approaches resonate with their decision-making styles.

Smarter Marketing Campaigns

Predictive analytics solutions optimize marketing investments by identifying which customers are most likely to respond to specific campaigns, reducing waste while increasing conversion rates and return on marketing spend.

Campaign targeting based on predictive analytics achieves 3-5 times higher response rates compared to broad demographic targeting, while reducing marketing costs through more efficient resource allocation.

Lifetime value predictions help marketers balance acquisition costs against predicted customer value, enabling more strategic decisions about marketing spend allocation across different customer segments and acquisition channels.

Propensity modeling identifies the optimal timing for marketing communications, increasing engagement rates by 35-50% through messages delivered when customers are most receptive to specific offers or content.

Better Sales Forecasting

Predictive analytics improve sales forecasting accuracy by analyzing customer behavior patterns, purchase history, and market conditions to predict future demand with greater precision than traditional methods.

For retailers, retail demand forecasting helps align inventory planning with customer purchasing trends, reducing stockouts and overstock issues while improving overall sales performance.

Lead scoring based on predictive models helps sales teams prioritize prospects who are most likely to convert, increasing sales productivity by 25-30% while improving conversion rates through better resource allocation.

Revenue forecasting incorporates customer lifetime value predictions and churn probability to create more accurate financial projections that support strategic planning and investment decisions.

Sales pipeline analysis identifies deals most likely to close and predicts timeline requirements, enabling better resource planning and more accurate revenue recognition.

Increased Customer Lifetime Value (CLV)

CLV optimization through predictive analytics identifies opportunities to increase customer value through targeted retention efforts, upselling strategies, and service improvements that strengthen customer relationships.

Predictive CLV models help organizations prioritize customer success investments on relationships with the highest long-term value potential, improving resource allocation efficiency and business outcomes.

Retention predictions enable proactive intervention strategies that prevent high-value customers from churning while identifying opportunities to increase value from existing relationships through relevant product recommendations and service enhancements.

Value-based customer service allocates support resources based on predicted customer value, ensuring that high-value relationships receive appropriate attention while maintaining cost efficiency for the broader customer base.

Leveraging customer service data analytics enhances this process by providing deeper insights into support interactions and their impact on long-term customer value.

Operational Efficiency

Predictive analytics optimize operational resource allocation by forecasting customer demand, support volume, and service requirements, enabling more efficient staffing and capacity planning.

AI demand forecasting enhances this capability by leveraging machine learning to predict purchasing behavior, seasonal demand fluctuations, and regional variations with greater accuracy.

Demand forecasting reduces inventory costs by 15-25% while improving product availability through more accurate predictions of customer purchase patterns and seasonal trends.

Support volume predictions enable optimal staffing decisions that balance service quality with operational efficiency, reducing wait times during peak periods while avoiding over-staffing during slower periods.

Process optimization based on customer behavior predictions streamlines workflows and eliminates bottlenecks that impact customer experience quality and operational costs.

Real-Time Decision Making

The benefits of real-time analytics become evident as predictive systems enable immediate responses to customer behavior changes, market conditions, and business opportunities that create competitive advantages through faster reaction times.

Dynamic pricing based on demand predictions and customer price sensitivity optimization increases revenue while maintaining competitive positioning in rapidly changing markets.

Instant personalization adjusts customer experiences in real-time based on current behavior and predicted preferences, creating engaging interactions that drive conversion and satisfaction.

Automated decision systems use predictive insights to trigger appropriate responses without human intervention, enabling consistent and timely customer management at scale.

What Real-World Examples Demonstrate Predictive Customer Analytics Value?

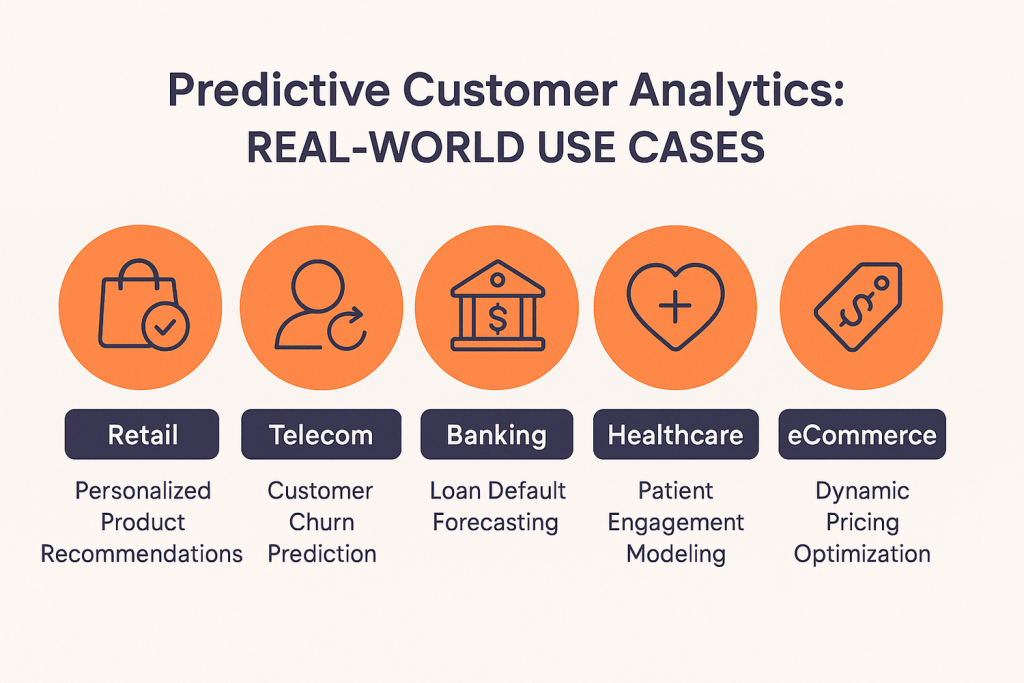

Different industries apply predictive customer analytics in ways that address their specific business challenges and competitive requirements.

Retail: Personalized Product Recommendations

Predictive analytics in retail, exemplified by Amazon’s recommendation engine, processes customer browsing history, purchase patterns, and product relationships to predict items customers are likely to purchase, generating 35% of total revenue through personalized suggestions.

Predictive models analyze seasonal trends, inventory levels, and customer preferences to optimize product placement and promotional strategies, increasing conversion rates while reducing inventory carrying costs.

Dynamic pricing algorithms adjust product prices in real-time based on demand predictions, competitor pricing, and customer price sensitivity analysis, optimizing revenue while maintaining market competitiveness.

Telecom: Customer Churn Prediction

Verizon uses predictive analytics to identify customers at risk of switching providers by analyzing usage patterns, billing history, and service interactions, achieving 89% accuracy in churn prediction.

Early warning systems trigger automatic retention campaigns including personalized offers, service improvements, or customer success outreach that reduce churn rates by 25% compared to reactive approaches.

Network optimization based on usage predictions improves service quality in areas where customer dissatisfaction might lead to churn, preventing service issues before they impact customer relationships.

Banking: Loan Default Forecasting

Data analytics in finance, as demonstrated by JPMorgan Chase, employs machine learning models that analyze credit history, income patterns, and economic indicators to predict loan default probability with 92% accuracy, reducing lending risk while maintaining competitive approval rates.

Credit limit optimization uses predictive models to set appropriate credit limits based on customer behavior patterns and financial stability indicators, balancing risk management with customer satisfaction.

Fraud detection systems analyze transaction patterns in real-time to identify suspicious activity, preventing fraudulent transactions while minimizing false positives that inconvenience legitimate customers.

Healthcare: Patient Engagement Modeling

Kaiser Permanente leverages predictive analytics in healthcare to identify patients at risk of missing appointments or failing to follow treatment protocols, enabling proactive outreach that improves health outcomes while reducing costs.

Risk stratification models predict which patients are likely to develop chronic conditions based on medical history, lifestyle factors, and genetic indicators, enabling preventive care interventions.

Resource planning based on patient flow predictions optimizes staffing and facility utilization while ensuring appropriate care capacity during peak demand periods.

eCommerce: Dynamic Pricing Optimization

Uber’s surge pricing algorithm uses predictive models to forecast demand patterns and adjust prices in real-time, balancing supply and demand while maximizing revenue during peak periods.

Inventory forecasting combined with purchase predictions reduces stockouts by 30% while minimizing excess inventory carrying costs through more accurate demand planning.

Personalized promotions triggered by purchase probability models increase conversion rates while maintaining profit margins through targeted discounting strategies.

What Limitations Should Organizations Consider?

Understanding predictive customer analytics limitations helps organizations set appropriate expectations and develop mitigation strategies for potential challenges.

Data Dependency

Predictive model accuracy depends entirely on data quality, completeness, and relevance. Poor data quality leads to inaccurate predictions that can harm business decisions and customer relationships.

Data integration challenges across multiple systems, including data lake challenges such as inconsistent schemas or unstructured data, can create gaps or inaccuracies that reduce prediction accuracy and limit the scope of analytical insights.

Model Accuracy Issues

Even sophisticated predictive models achieve 85-90% accuracy at best, meaning 10-15% of predictions will be incorrect, potentially leading to inappropriate business actions or resource allocation decisions.

Model performance can degrade over time as customer behavior patterns change, market conditions evolve, or business strategies shift, requiring continuous monitoring, updates, and analytics optimization to sustain effectiveness.

Complex models may be difficult to interpret or explain, making it challenging to understand why specific predictions were made or to identify areas for improvement.

Privacy Concerns

Predictive analytics often require extensive personal data collection and analysis, creating privacy risks that must be balanced against business benefits while maintaining customer trust.

Regulatory compliance requirements like GDPR and CCPA limit data collection and usage practices, potentially constraining model accuracy or analytical capabilities.

Customer concerns about data usage can impact brand reputation and customer relationships if predictive analytics practices are perceived as invasive or manipulative.

High Implementation Cost

Predictive analytics platforms, data infrastructure, and skilled personnel represent significant investments that may not be justified for organizations with limited customer data or simple business models.

Ongoing maintenance, model updates, and system integration requirements create substantial operational costs beyond initial implementation investments.

Return on investment may take 12-18 months to realize, requiring patience and sustained commitment from organizational leadership.

Scalability Challenges

Processing large volumes of customer data in real-time requires substantial computing resources and infrastructure investments that may exceed organizational capabilities.

Model complexity increases exponentially with data volume and customer base size, potentially creating performance bottlenecks that limit analytical effectiveness.

Integration with existing business systems may require significant technical modifications that disrupt current operations or limit analytical capabilities, an area where partnering with a data integration consultancy can help organizations streamline processes and reduce risks.

Lack of Context

Predictive models may miss important contextual factors that influence customer behavior but aren’t captured in quantitative data, leading to predictions that don’t account for real-world complexity.

External factors like economic conditions, competitive actions, or social trends may not be reflected in historical customer data, limiting model accuracy during periods of significant change.

Individual customer circumstances or preferences that don’t follow typical patterns may not be predicted accurately by models trained on aggregate behavior data.

What Best Practices Ensure Predictive Customer Analytics Success?

Strategic implementation approaches maximize the value of predictive customer analytics while minimizing common pitfalls and challenges.

Define Clear Goals

Successful implementations start with specific, measurable objectives aligned with your overall data analytics strategy, connecting predictive analytics capabilities to business outcomes like revenue growth, cost reduction, or customer satisfaction improvement.

Goal definition should include success metrics, timeline expectations, and resource allocation plans that enable realistic project planning and performance measurement.

Business alignment ensures that predictive analytics initiatives support strategic priorities rather than just technical capabilities, increasing organizational support and resource availability.

Collect Quality Data

Data quality investment pays dividends through improved prediction accuracy and business decision effectiveness, making it worth significant attention and resources during implementation planning.

Comprehensive data audits identify gaps, inconsistencies, and quality issues that could undermine analytical effectiveness, enabling targeted improvements before model development begins.

A well-defined data governance strategy ensures ongoing quality maintenance and compliance with privacy regulations while enabling analytical innovation and business value creation.

Segment Your Customers

Customer segmentation enables more accurate predictions by grouping customers with similar characteristics and behavior patterns, improving model performance and business relevance.

Dynamic segmentation approaches update customer classifications as behavior changes, ensuring that predictive models remain accurate and business strategies stay relevant.

Segment-specific models often achieve higher accuracy than general models because they account for the unique patterns and preferences within customer groups.

Choose the Right Tools

Platform selection should balance analytical capabilities with effective data visualization tools, while considering organizational technical capacity, budget constraints, and integration requirements with existing business systems.

Cloud-based platforms often provide better scalability and lower initial costs compared to on-premises solutions, while offering access to advanced AI capabilities without internal development requirements.

Vendor evaluation should include proof-of-concept testing with actual customer data to validate performance claims and ensure platform suitability for specific business requirements.

Start with Pilots

Pilot projects enable organizations to validate predictive analytics value and refine implementation approaches before large-scale deployment, reducing risk and improving success probability.

Pilot selection should focus on use cases with clear business value, measurable outcomes, and manageable complexity to demonstrate success and build organizational confidence.

Success measurement during pilots provides evidence for broader investment decisions and helps identify implementation best practices that can be scaled across the organization.

Monitor and Refine

Continuous model monitoring ensures prediction accuracy remains high as business conditions change and customer behavior evolves, maintaining analytical value over time.

Performance tracking should include accuracy metrics, business impact measurement, and user satisfaction assessment to provide comprehensive views of analytical effectiveness.

Model updates based on new data and changing conditions prevent performance degradation while incorporating learning from business outcomes and customer feedback.

Ensure Data Compliance

Privacy regulation compliance protects organizations from legal risks while maintaining customer trust that enables continued data collection and analytical innovation.

Compliance frameworks should include data minimization practices, consent management, and audit trails that demonstrate appropriate data handling throughout the analytical process.

For companies lacking in-house expertise, partnering with customer analytics consulting firms can help establish compliance-ready frameworks while maximizing the value of customer data.

Customer communication about data usage builds trust and acceptance while meeting transparency requirements that support long-term analytical capabilities.

Invest in Talent

Skilled personnel are essential for successful predictive analytics implementation, requiring investment in hiring, training, or consulting relationships that provide necessary expertise.

Cross-functional teams combining data science skills with business domain knowledge achieve better outcomes than purely technical or business-focused approaches.

Many organizations also partner with providers of data and analytics services to fill capability gaps, accelerate implementation, and ensure teams stay current with evolving technologies.

Ongoing education ensures that teams stay current with evolving technologies and methodologies while building organizational analytical capabilities over time.

Find the gaps, fix the pain points, win loyalty.

Do’s and Don’ts of Predictive Customer Analytics

Strategic guidelines help organizations avoid common mistakes while maximizing the value of predictive customer analytics investments.

Do’s

- Start with Clear Objectives that connect analytical capabilities to specific business outcomes, ensuring that predictive analytics investments create measurable value rather than just technical sophistication.

- Use High-Quality Data by investing in data collection, integration, and governance processes that provide accurate, complete, and relevant information for model development and ongoing operations.

- Validate Models Regularly through performance monitoring, accuracy testing, and business outcome measurement that ensures predictions remain reliable and actionable over time.

- Focus on Customer Value by ensuring that predictive analytics improve customer experiences and outcomes rather than just internal operational efficiency or cost reduction.

- Ensure Data Privacy Compliance through appropriate governance frameworks, customer consent processes, and transparency practices that maintain trust while enabling analytical innovation.

- Collaborate Across Teams by involving business stakeholders, technical teams, and customer-facing personnel in analytical initiatives to ensure practical relevance and organizational adoption.

Don’ts

- Don’t rely on assumptions about customer behavior or market conditions without validating them through data analysis and testing, as incorrect assumptions can undermine analytical accuracy and business value.

- Don’t Ignore Data Gaps that could limit model accuracy or business applicability, as incomplete data often leads to biased or unreliable predictions that harm decision-making.

- Don’t Overcomplicate Models unnecessarily, as simpler models that are easier to understand and maintain often provide better long-term value than complex approaches that are difficult to operate.

- Don’t Neglect Human Oversight of automated analytical processes, as human judgment remains essential for interpreting results, handling exceptions, and making strategic decisions.

- Don’t Disregard Compliance Rules regarding data privacy, customer consent, and regulatory requirements, as violations can create legal risks and damage customer relationships.

- Don’t Set It and Forget It with analytical models, as changing conditions require ongoing monitoring, updates, and refinements to maintain accuracy and business relevance.

FAQs

How does predictive analytics help improve customer experience?

Predictive analytics enable personalized experiences by forecasting customer preferences, optimal interaction timing, and service needs before issues arise. This proactive approach increases satisfaction by 35% while reducing service costs through prevention rather than reaction.

What kind of data is used in predictive customer analytics?

Predictive models use transaction history, interaction records, demographic information, behavioral patterns, and external data like market trends. The combination of structured and unstructured data from multiple touchpoints creates comprehensive customer profiles that support accurate predictions.

Which industries benefit most from predictive customer analytics?

Industries with recurring customer relationships and complex buying behaviors see the greatest benefits, including retail, telecommunications, financial services, and healthcare. However, any business with substantial customer data can gain competitive advantages through predictive insights.

How can small businesses use predictive customer analytics?

Small businesses can use cloud-based analytics platforms that provide sophisticated capabilities without large infrastructure investments. Starting with simple use cases like email campaign optimization or inventory forecasting enables value creation while building analytical capabilities over time.

Conclusion

Predictive customer analytics transforms how organizations understand and serve their customers by converting historical data into forward-looking intelligence that drives strategic decision-making. The ability to anticipate customer needs, prevent churn, and optimize experiences creates sustainable competitive advantages in increasingly customer-centric markets.

Success requires more than just implementing advanced technology. Organizations must invest in data quality, analytical talent, and business process integration while maintaining focus on customer value creation rather than just operational efficiency. The companies that master this balance will build stronger customer relationships and achieve superior business performance.

The future belongs to organizations that can predict and proactively address customer needs rather than simply respond to problems after they occur. Predictive customer analytics provides the foundation for this transformation, and partnering with experts like Folio3 Data can help in enabling businesses to become truly customer-centric while achieving measurable improvements in retention, growth, and profitability.