Data analytics has transformed from a nice-to-have capability to a business imperative in 2026. Organizations across every sector now rely on data-driven insights to navigate competitive markets, optimize operations, and deliver personalized customer experiences. The numbers tell a compelling story of rapid adoption and substantial returns on investment.

Modern enterprises use analytics to power strategic decision-making, reduce operational costs, and uncover new revenue opportunities. From retail giants personalizing shopping experiences to healthcare systems predicting patient outcomes, analytics has become the engine driving business transformation across departments and industries.

What started as basic reporting has evolved into sophisticated predictive and prescriptive analytics powered by artificial intelligence and machine learning. As of 2026, over 65% of organizations have adopted or are actively investigating AI technologies for data and analytics. This shift represents more than technological advancement. It signals a fundamental change in how businesses operate and compete.

The analytics industry itself has become a global economic force, generating hundreds of billions in revenue while creating new job categories and skill requirements. This comprehensive analysis examines the latest statistics, market projections, and industry trends that define the data analytics industry in 2026.

Key Data Analytics Statistics (Editor’s Pick)

- 91.9% of organizations gained measurable value from their data and analytics investments.

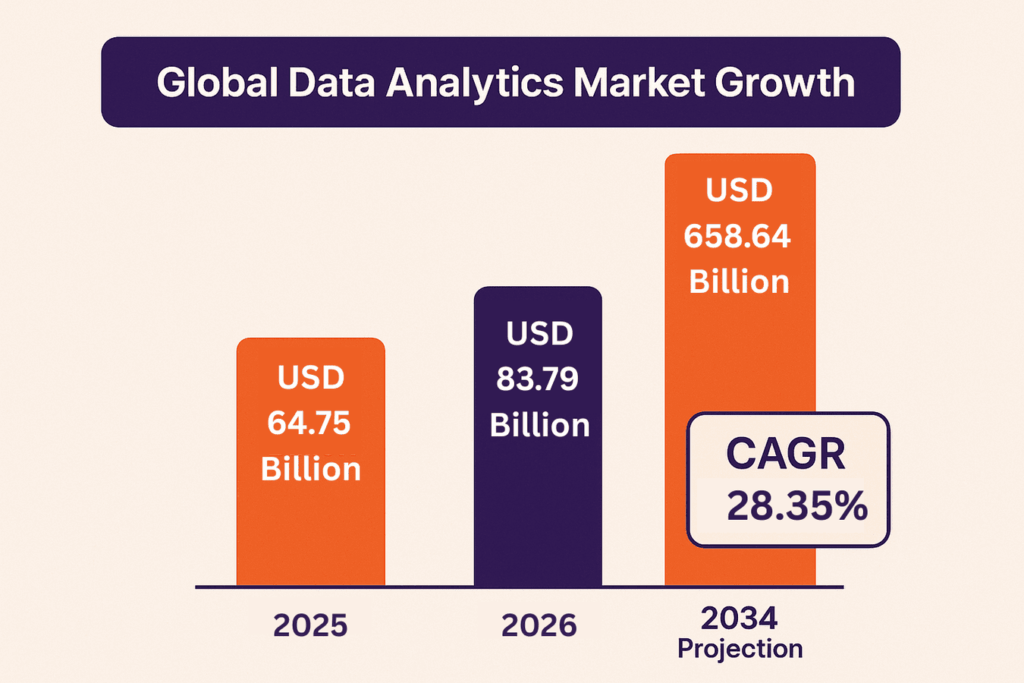

- By the end of 2026, the global data analytics market is expected to reach $83.79 billion, growing at a 28.35% CAGR.

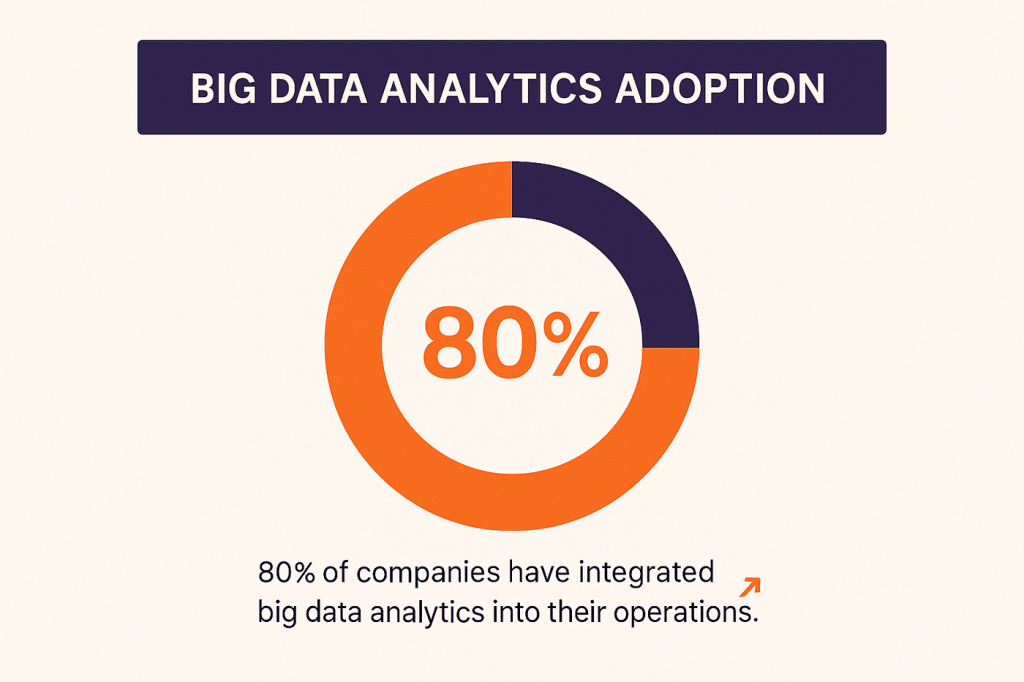

- 80% of companies have integrated big data analytics into their operations

- 60% of Data Leaders Prioritize Data Governance for Effective Management

- Poor data quality costs companies 12% of their revenue annually

- 66% of CEOs report measurable business benefits from generative AI initiatives

- Business intelligence implementations deliver 127% ROI within three years

Data Analytics Industry and Market Statistics – What’s Going on?

The data analytics market represents one of the fastest-growing technology sectors globally, with multiple research firms projecting explosive growth through 2030.

Global Market Growth and Projections

Market size projections vary across research firms, but all indicate unprecedented growth. The global data analytics market reached USD 64.75 billion in 2025, is projected to reach approximately USD 83.79 billion by the end of 2026, and is expected to surpass around USD 658.64 billion by 2034, reflecting substantial growth at a 28.35% CAGR over the period.

Different market segments show varying growth patterns. The Data Analytics market size is projected to grow to USD 303.4 billion by 2030, exhibiting a CAGR of 27.60% during the forecast period (2024 – 2030). Meanwhile, specialized segments like high-performance data analytics are experiencing even more rapid expansion.

| Market Segment | 2026 Value | 2030 Projection | CAGR |

| Overall Data Analytics | $83.79 B | $303.4B | 27.60% |

| High-Performance Analytics | $153 – 160 B | $335.93B | 21.67% |

| Big Data Analytics | $88 – 90 B | $400B+ | ~30% |

Regional Market Distribution

North America continues to dominate the global analytics market, driven by early adoption among technology companies and substantial venture capital investment. However, Asia-Pacific regions are experiencing the fastest growth rates as emerging economies invest heavily in digital infrastructure and analytics capabilities.

European markets focus heavily on compliance-driven analytics, particularly in response to GDPR and other regulatory requirements. This has created specialized demand for privacy-preserving analytics technologies and the development of a robust data governance strategy to ensure both compliance and trust in analytics practices.

North America

- In 2023, North America accounted for over 51% of global cloud analytics revenues, underscoring its leadership position

- It remains the largest regional market by adoption, supported by early technology integration and major cloud providers like AWS, Microsoft Azure, and Google Cloud

Asia-Pacific

- APAC is the fastest-growing region, with projections showing a CAGR of approximately 25.5% (2024–2032).

- Factors boosting this growth include digital infrastructure expansion, smart city programs, and rapid cloud adoption in countries like China, India, and Japan

Europe

- Europe is growing steadily with a projected CAGR of about 20.4% in cloud analytics adoption.

- Much of this demand is fueled by compliance needs (e.g., GDPR) driving investment in privacy-conscious analytics platforms and governance tools

| Region | Market Share / Role | Growth Highlights |

| North America | Largest market (>51%) | Steady, dominant position |

| Asia-Pacific | Fastest growth | CAGR ~25.5% (2024-2032) |

| Europe | Significant adopter | CAGR ~20.4%; compliance-led |

Analytics as a Service (AaaS) Growth

Cloud-based analytics platforms have democratized access to sophisticated analytical capabilities. Small and medium enterprises can now access the same analytical tools previously available only to large corporations with substantial IT budgets, with cloud data integration playing a key role in connecting diverse sources seamlessly.

The shift toward subscription-based analytics services has created more predictable revenue models for vendors while reducing upfront costs for customers. This trend has accelerated analytics adoption across industry sectors that previously couldn’t justify large capital investments in analytical infrastructure.

Data Analytics Business Adoption & ROI

Business adoption of analytics has reached a tipping point where organizations without robust analytical capabilities face significant competitive disadvantages.

1. Enterprise Adoption Rates

Companies have started integrating big data analytics into their operations, accounting for 80% of the participation rate. This represents a dramatic increase from just a few years ago, when analytics adoption was concentrated among technology-forward industries.

As organizations refine their data analytics strategies, they’re moving beyond experimentation to enterprise-wide adoption, ensuring analytics becomes a core driver of decision-making and growth.

The adoption pattern shows a clear correlation with organizational size and industry maturity. Large enterprises lead adoption rates, but small and medium businesses are rapidly closing the gap as cloud-based solutions reduce implementation barriers.

72% of data & analytics leaders are either leading or heavily involved in their organization’s digital transformation initiatives, indicating that analytics has moved from operational support to strategic leadership roles within organizations.

2. ROI and Business Impact Metrics

Return on investment data demonstrates substantial value creation from analytics investments. The benefits of data analytics are evident, as the implementation of a BI solution can result in a 127% return on investment (ROI) in three years, making analytics one of the highest-ROI technology investments available to businesses.

However, ROI realization requires proper implementation and organizational commitment. Only 11% of data leaders consider their D&A efforts to be business consequences, while more than 50% do not formally track ROI. This suggests significant room for improvement in how organizations measure and optimize their analytics investments.

| ROI Metric | Percentage/Value |

| 3-Year BI Implementation ROI | 127% |

| Organizations tracking D&A ROI | <50% |

| Revenue impact from poor data quality | 12% |

| Unused data for strategic purposes | 60-73% |

3. Decision-Making Speed and Accuracy

Analytics implementation consistently improves decision-making capabilities across organizations. Companies with mature analytics capabilities report faster response times to market changes and more accurate forecasting of business trends.

The integration of real-time data collection and analytics has enabled organizations to shift from reactive to proactive decision-making processes. This capability has proven especially valuable in volatile market conditions where rapid response can determine competitive outcomes.

Industry-Specific Data Analytics Statistics

Different industries have adopted analytics at varying rates and for distinct use cases, creating specialized market segments with unique growth patterns and requirements.

1. Retail & eCommerce Analytics Statistics

Retail analytics focuses heavily on personalization and customer experience optimization. E-commerce platforms use analytics to power recommendation engines, optimize pricing strategies, and predict customer behavior patterns.

In fact, predictive analytics in retail has become central to anticipating demand shifts and guiding inventory decisions, helping businesses stay competitive in fast-changing markets.

Dynamic pricing algorithms have become standard across major retail platforms, with some companies adjusting prices multiple times per day based on demand patterns, competitor analysis, and inventory levels. Customer analytics enable personalization at scale, with leading retailers achieving significant increases in conversion rates through targeted experiences.

Key Stats:

- 92% of top eCommerce firms now use AI-driven personalization tools, making it nearly ubiquitous among leading retailers.

- Shoppers respond: 80–85% of consumers are more likely to purchase from brands that personalize their experience.

2. Healthcare Analytics Statistics

Healthcare analytics has experienced explosive growth driven by value-based care initiatives and regulatory requirements for outcome measurement. Predictive modeling helps identify high-risk patients and optimize treatment protocols.

AI-powered diagnostics represent a rapidly growing segment within healthcare analytics, with machine learning models achieving diagnostic accuracy rates comparable to or exceeding human specialists in specific domains.

Key Stats:

- The global healthcare predictive analytics market, which was USD 20.16 billion in 2021, is expected to skyrocket to USD 74.62 billion by 2028, reflecting a robust CAGR of 27%.

- In the U.S., this market stood at USD 4.88 billion in 2023, with projections reaching USD 53.16 billion by 2034, growing at a 24.2% CAGR. North America accounted for 48% of revenue share in 2023, with APAC identified as the fastest-growing region.

3. Banking & Finance Analytics Statistics

Financial services lead analytics adoption due to regulatory requirements and the data-intensive nature of financial operations. Fraud detection systems process millions of transactions in real-time, identifying suspicious patterns with increasing accuracy.

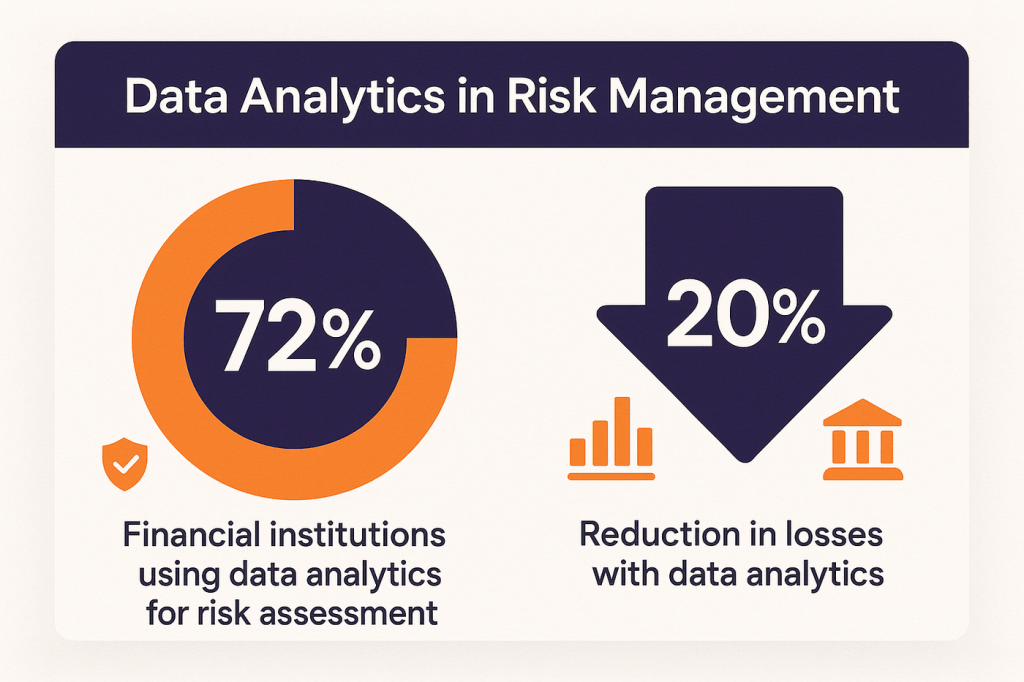

Data analytics in finance also plays a pivotal role in risk management, helping institutions optimize lending decisions while maintaining regulatory compliance. Investment firms increasingly rely on sophisticated analytical models to uncover market opportunities and manage portfolio risk effectively.

Key Stats:

- 91% of U.S. banks use AI-powered big data systems for fraud detection in 2025—enabling detection of 95% of high-risk transactions before they result in losses.

- 72% of financial institutions employ data analytics for risk assessment and management, cutting losses by up to 20%.

- In the U.K., major banks and tech firms have begun sharing live fraud data, enabling detection of fraudulent activity a full day earlier than traditional systems.

4. Telecom & Media Analytics Statistics

Telecommunications companies use analytics primarily for churn prediction and network optimization. Customer segmentation enables targeted retention campaigns and service offerings.

Media companies leverage analytics for content recommendation and advertising optimization. Streaming services use viewer analytics to guide content creation and acquisition decisions.

Key Stats:

- 65–75% of telecom companies have adopted AI technologies to enhance customer service and experiences.

- The content recommendation engine market is estimated at USD 6.15 billion in 2025, projected to reach USD 26.21 billion by 2030—boasting a robust CAGR of 33.6%.

5. Manufacturing & Supply Chain Analytics Statistics

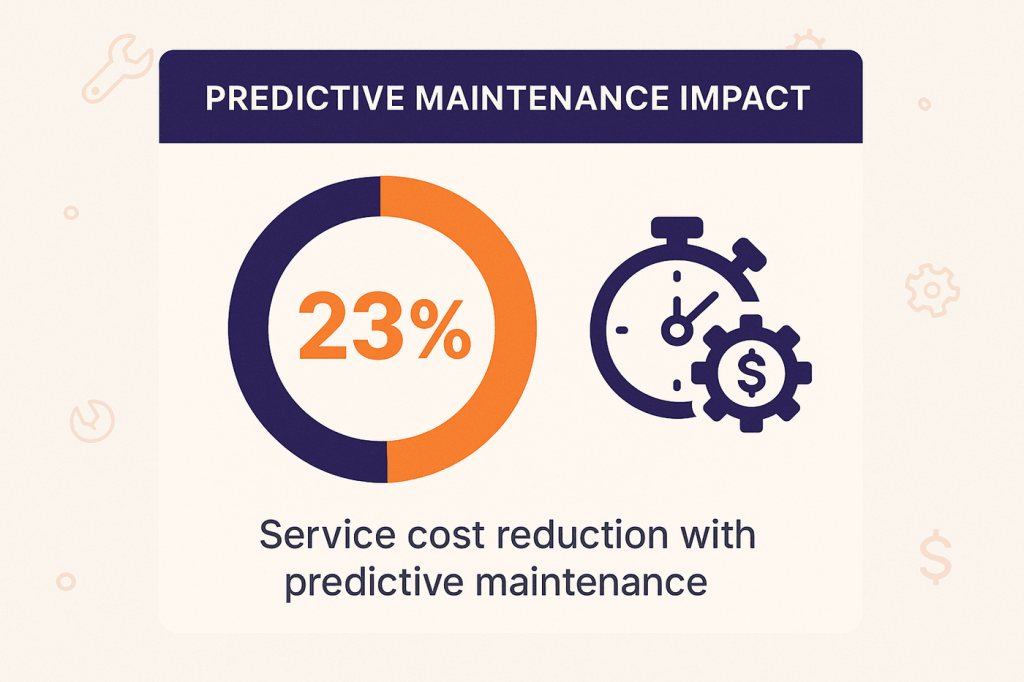

Predictive maintenance has become a primary use case for manufacturing analytics, helping companies reduce equipment downtime and maintenance costs. Supply chain analytics optimizes inventory levels and distribution networks.

IoT sensors generate massive amounts of operational data, and with real time manufacturing data collection, analytics platforms can process this information instantly to identify efficiency opportunities and quality improvements.

Key Stats:

- Unplanned equipment failures can cost the world’s 500 largest companies up to USD 1.4 trillion annually.

- Predictive maintenance solutions can reduce service costs by up to 23% by preventing unnecessary repairs (e.g., for clients like Coca-Cola and Siemens Energy).

6. Government & Public Sector Analytics Statistics

Government agencies use analytics for policy development and service optimization. Smart city initiatives rely heavily on data analytics to improve urban planning and public service delivery. Public sector analytics often focus on improving citizen services and operational efficiency rather than revenue generation.

Key Stats:

- In the U.S., 64% of municipalities are deploying AI-powered urban analytics; 58% are using smart public safety systems, and 49% have real-time traffic management technologies.

- Across cities like Houston, Singapore, and Amsterdam, over 500 cities by 2025 are expected to deploy digital twin technology for climate resilience—helping monitor air quality, manage floods, and optimize urban systems.

Data Analytics Career Trends

The rapid growth in analytics adoption has created substantial demand for skilled professionals across multiple role categories.

Job Market Growth and Demand

Analytics roles consistently rank among the fastest-growing job categories. Data scientist positions continue to show strong growth, but demand has expanded to include specialized roles like analytics engineers and machine learning operations specialists.

The skills gap in analytics remains significant, with many organizations reporting difficulty finding qualified candidates. This has led to substantial salary premiums for experienced analytics professionals.

Salary Benchmarks by Role and Region

Analytics salaries vary significantly by role, experience level, and geographic location. Senior data scientists and machine learning engineers command the highest salaries, particularly in major technology hubs.

| Role | Average Salary (US) | Growth Rate |

| Data Scientist | $120,000-180,000 | 15% annually |

| Data Engineer | $110,000-160,000 | 20% annually |

| Analytics Manager | $130,000-200,000 | 12% annually |

| ML Engineer | $140,000-220,000 | 25% annually |

In-Demand Skills and Technologies

Python and SQL remain the most in-demand technical skills for analytics roles. Cloud platform expertise has become increasingly important as organizations migrate analytics workloads to cloud environments.

Machine learning and AI skills command premium salaries, particularly for professionals with practical experience deploying models in production environments.

Consumer & Behavioral Analytics Statistics

Consumer analytics drive personalization strategies across multiple industries, with measurable impacts on customer engagement and retention rates.

Customer Experience and Personalization

Businesses using customer experience analytics report significant improvements in engagement and satisfaction metrics. Personalized experiences consistently outperform generic approaches across key performance indicators.

The ability to analyze customer behavior in real-time has enabled more responsive service delivery and proactive customer support strategies.

Retention and Revenue Impact

Analytics-driven personalization strategies show measurable impact on customer retention and revenue per customer. Companies with sophisticated customer analytics capabilities typically achieve higher customer lifetime values and lower acquisition costs.

Key Stats:

- Companies implementing personalization typically see a 10–15% revenue uplift, with some achieving 5–25% gains depending on sector and execution.

- Recent findings show personalization can also boost customer retention by 25%, increase average order value by 30%, and lift overall revenue by 40% compared to competitors.

- Firms with exceptional customer experience (CX) see 70% higher retention and 190% greater revenue growth over three years versus peers.

Data Analytics Challenges & Limitations Statistics

Despite widespread adoption, organizations continue to face significant challenges in maximizing the value of analytics.

Data Quality and Governance Issues

Poor data costs companies 12% of revenue, while between 60% and 73% of the data is left unused for any strategic purpose. Data quality remains a fundamental challenge that limits the effectiveness of analytics across organizations.

Establishing a robust data analytics framework helps ensure data is properly structured, validated, and ready to drive meaningful insights.

Data governance frameworks have become essential for managing data quality and ensuring compliance with regulatory requirements. Organizations with mature data governance programs report higher analytics ROI and fewer compliance issues.

Privacy and Compliance Challenges

Regulatory compliance adds complexity to analytics implementations, particularly for organizations operating across multiple jurisdictions. GDPR, CCPA, and similar regulations require sophisticated data handling capabilities.

Privacy-preserving analytics techniques are becoming more critical as organizations balance analytical insights with privacy protection requirements.

Adoption Barriers and Solutions

Cost remains a significant barrier for smaller organizations, though cloud-based data analytics services and solutions are reducing entry barriers. The talent gap continues to challenge analytics adoption, with many organizations struggling to find qualified professionals.

Training and skill development programs have become essential for organizations seeking to build internal analytics capabilities.

Future of Data Analytics – Trends to Watch

The analytics industry continues evolving rapidly, with several data analytics trends likely to shape future development.

AI-Powered Analytics Dominance

Artificial intelligence integration is transforming analytics from descriptive to predictive and prescriptive capabilities. Emerging approaches, such as generative AI for data analytics, are opening new possibilities by automating insight generation and enhancing decision-making across industries. Automated machine learning platforms are also democratizing advanced analytics by reducing the technical expertise required for implementation.

Real-Time and Edge Analytics

The combination of IoT devices and edge computing is enabling real-time analytics at unprecedented scale. This capability supports applications requiring immediate response times and reduces dependence on centralized processing infrastructure.

Integration with Emerging Technologies

Analytics platforms are increasingly integrating with IoT sensors, blockchain networks, and augmented reality systems. These integrations create new analytical capabilities and use cases across industries.

The convergence of analytics with automation technologies is enabling autonomous decision-making systems that can respond to changing conditions without human intervention.

Conclusion

Data analytics has become fundamental to modern business operations, with market growth projections indicating continued rapid expansion through the decade. Organizations that have successfully implemented analytics capabilities report substantial returns on investment and competitive advantages.

The statistics reveal both the tremendous opportunities and persistent challenges in analytics adoption. While most organizations have begun integrating analytical capabilities, many have yet to realize the full potential of their data assets.

The future belongs to organizations that can effectively combine human expertise with analytical capabilities to create sustainable competitive advantages. As the technology continues evolving, the focus must shift from basic adoption to optimization and strategic application of analytics capabilities.

Folio3 Data Services helps organizations achieve this transition by offering end-to-end data engineering, advanced analytics, and AI-driven solutions. With expertise in building scalable data pipelines, integrating real-time analytics, and designing custom data strategies, Folio3 empowers businesses to move beyond simple adoption and unlock the true value of their data for growth and innovation.

References

- Market Research Future. (2025). Data Analytics Market Size, Share | Growth Analysis 2030. https://www.marketresearchfuture.com/reports/data-analytics-market-1689

- Precedence Research. (2024). Data Analytics Market Size to Hit USD 658.64 Billion by 2034. https://www.precedenceresearch.com/data-analytics-market

- EdgeDelta. (2025). 10 Eye-Opening Data Analytics Statistics for 2025. https://edgedelta.com/company/blog/data-analytics-statistics

- Coherent Solutions. (2025). The Future of Data Analytics: Trends in 7 Industries [2025]. https://www.coherentsolutions.com/insights/the-future-and-current-trends-in-data-analytics-across-industries

- Scoop Market. (2025). Business Intelligence Statistics and Facts (2025). https://scoop.market.us/business-intelligence-statistics/

- Microsoft. (2025). AI-powered success with more than 1,000 stories of customer transformation and innovation. https://www.microsoft.com/en-us/microsoft-cloud/blog/2025/07/24/ai-powered-success-with-1000-stories-of-customer-transformation-and-innovation/

- ElectroIQ. (2025). Data Governance Statistics And Facts (2025) https://electroiq.com/stats/data-governance/

- Exploding Topics: (2023 Data Stats Research Article) – 91.9% of organizations achieved clear value through data and analytics initiatives.

https://explodingtopics.com/blog/data-analytics-stats - With 51% of global cloud analytics revenue, North America holds the top position. https://www.precedenceresearch.com/cloud-analytics-market

- North America Dominates Cloud Analytics Market, While Asia Pacific Set for Fastest Growth

https://www.globenewswire.com/news-release/2025/03/24/3047969/0/en/Cloud-Analytics-Market-Size-to-Surpass-USD-203-48-Billion-by-2032-Owing-to-Rising-Demand-for-Real-Time-Data-Insights-Research-by-SNS-Insider.html - Europe’s cloud analytics market is set to grow at a 20.4% CAGR. https://www.fortunebusinessinsights.com/cloud-analytics-market-102248

- AI-driven personalization is used by 92% of top eCommerce retailers. https://www.designrush.com/agency/ecommerce/trends/ecommerce-statistics

- 80–85% of consumers prefer buying from brands that personalize experiences https://www.sellerscommerce.com/blog/ai-in-ecommerce-statistics/

- Healthcare predictive analytics will grow from USD 20.16B to USD 74.62B by 2028 at a 27% CAGR https://www.globenewswire.com/news-release/2023/04/04/2641039/0/en/Healthcare-Predictive-Analytics-Market-Size-Share-to-Surpass-74-62-Billion-by-2028-Vantage-Market-Research.html

- USD 4.88B U.S. market in 2023 projected to hit USD 53.16B by 2034 at 24.2% CAGR; NA leads, APAC surging. https://www.precedenceresearch.com/healthcare-predictive-analytics-market

- 91% of U.S. banks use AI-powered big data to detect 95% of high-risk transactions before losses. https://coinlaw.io/big-data-in-finance-statistics/

- 72% of financial firms leverage analytics for risk assessment, lowering losses up to 20%. https://www.linkedin.com/pulse/data-analytics-trends-2025-financial-qkqfc/

- Live fraud data sharing in the U.K. lets banks detect fraud 24 hours faster. https://www.ft.com/content/12bbd99e-ed46-418d-bc15-04433e13db30

- Content recommendation engines: USD 6.15B (2025) → USD 26.21B (2030) at 33.6% CAGR. https://www.mordorintelligence.com/industry-reports/content-recommendation-engine-market

- Predictive maintenance saves up to 23% in service costs, addressing the USD 1.4T annual losses from equipment failures. https://www.businessinsider.com/artificial-intelligence-robotics-predictive-maintenance-manufacturing-factory-solutions-2025-5

- 64% of U.S. municipalities use AI analytics, 58% smart safety, and 49% traffic management tech. https://www.globalgrowthinsights.com/market-reports/smart-cities-market-114595

- 500+ cities worldwide, from Houston to Amsterdam, adopting digital twins by 2025 for climate resilience. https://www.reuters.com/sustainability/climate-energy/how-ai-is-arming-cities-battle-climate-resilience-2024-05-23/

- Personalization drives a 10–15% revenue lift, with gains up to 25% by sector.https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-value-of-getting-personalization-right-or-wrong-is-multiplying

- Personalization boosts retention by 25%, order value by 30%, and revenue by 40% over competitors. https://www.onrampfunds.com/resources/roi-of-personalization-for-retention-and-clv

- Firms with strong CX achieve 70% higher retention and 190% faster revenue growth over three years. https://www.nextiva.com/blog/how-to-measure-customer-experience.html