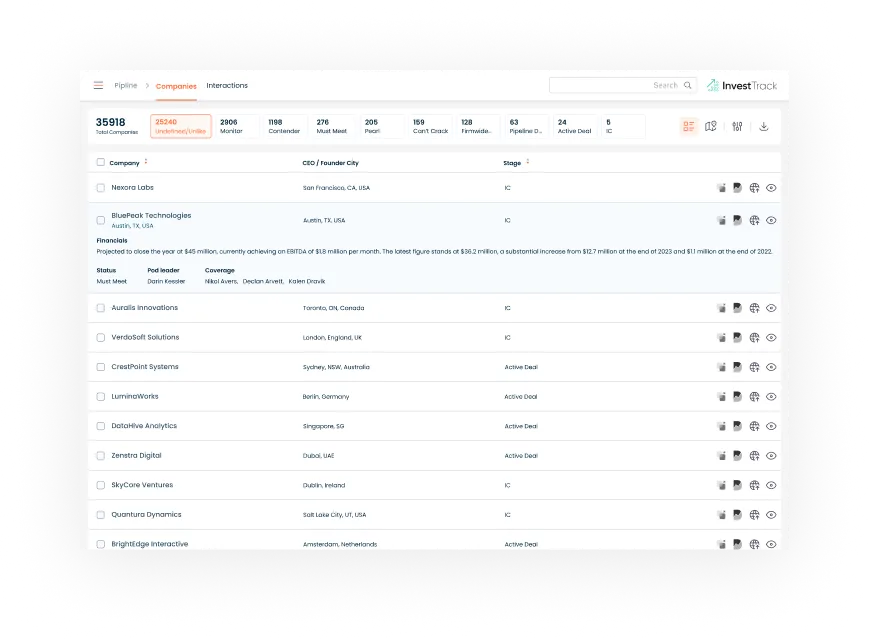

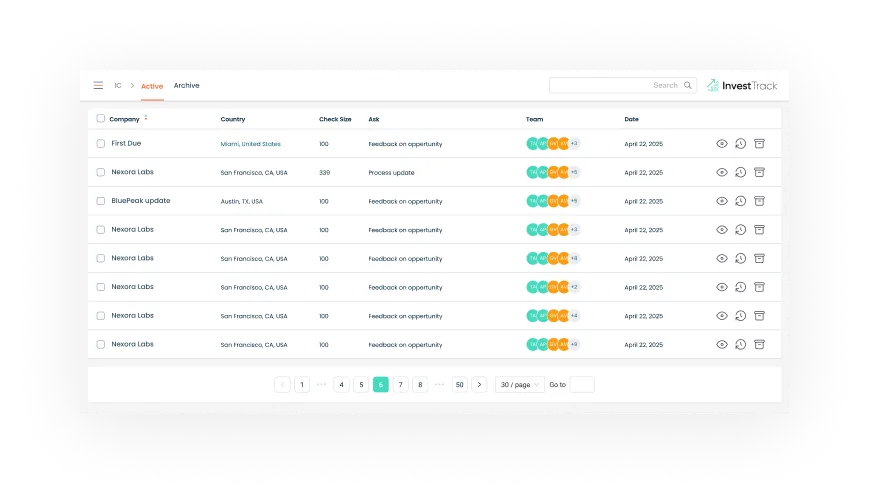

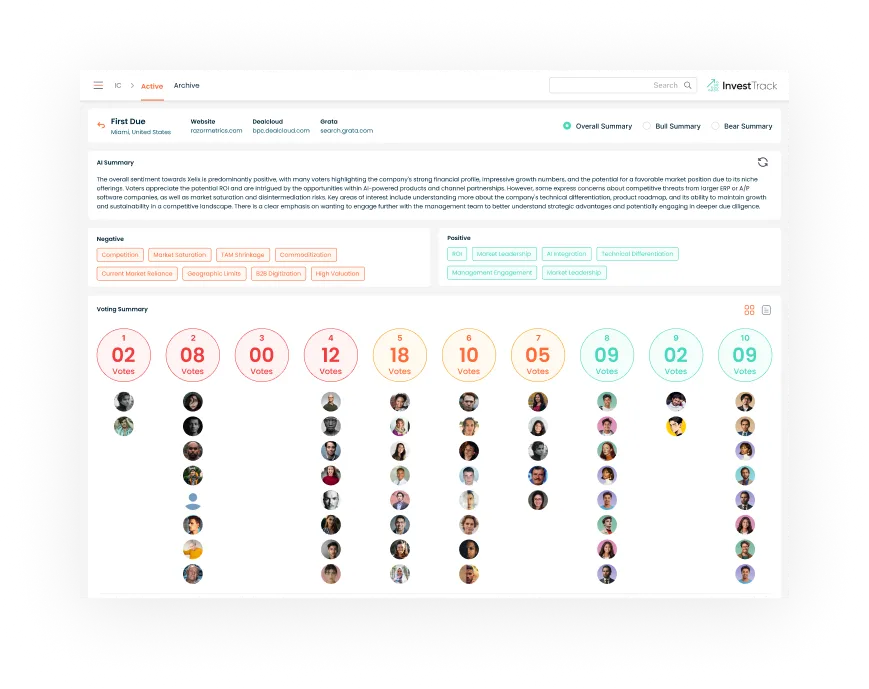

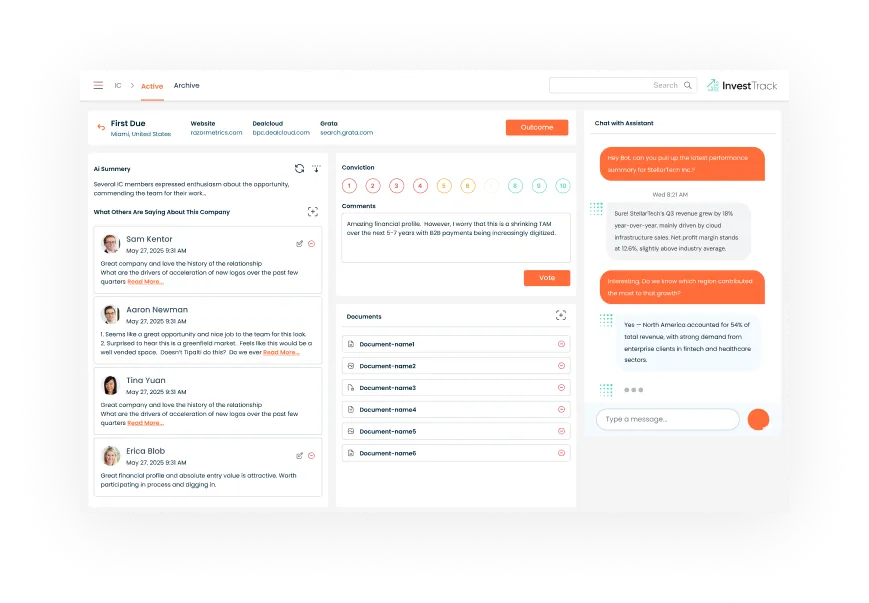

Venture Capital Deal Flow Management Software for

Logical Investment Decisions

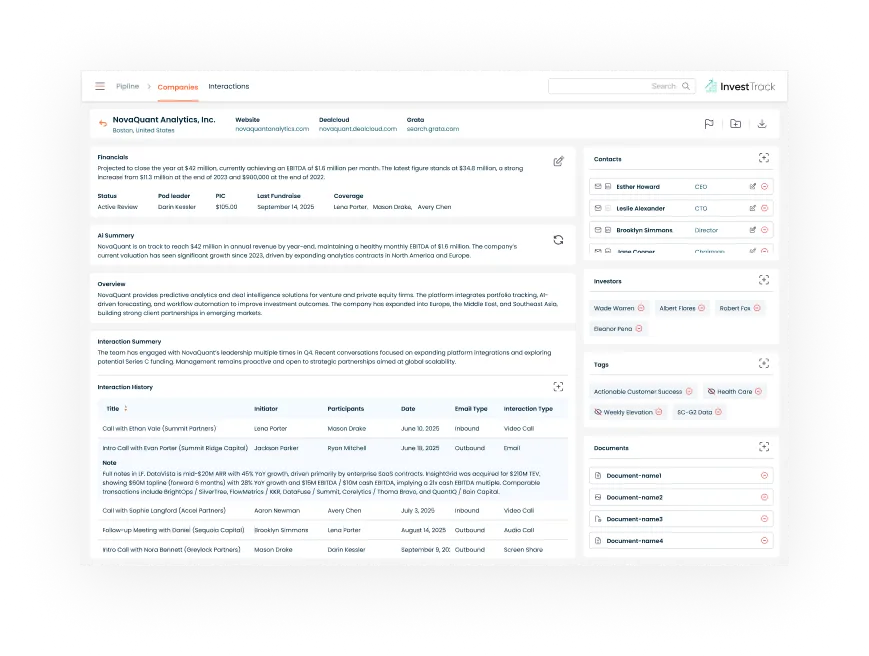

Stop shooting in the dark. Our AI-powered venture capital deal flow management software consolidates disparate companies’ details and financials into a unified platform, empowering your investment team to evaluate high-potential companies with confidence and precision.