Private equity involves investment firms acquiring stakes in privately held companies, improving their value, and eventually selling them for returns. When we discuss AI in PE, we’re talking about applying machine learning, predictive analytics, natural language processing, and automation to investment activities from deal sourcing to company monitoring to exit planning.

This matters now because PE firms face intense competition for quality deals while limited partners demand better transparency and returns.

Technology has evolved to the point where sophisticated analytical tools are accessible to funds beyond the most significant ones. PE operations generate massive amounts of data from financial records, market research, operational metrics, and external sources. Making sense of this information manually has become impractical.

This guide addresses fund managers looking to improve investment processes, portfolio company executives implementing performance improvements, limited partners evaluating fund capabilities, and buy-side analysts building better frameworks.

Understanding how artificial intelligence is changing private equity operations has become necessary to stay competitive in institutional investing.

The Role of AI in Modern Private Equity

The integration of AI in private equity is revolutionising how firms source deals, evaluate risk, and drive value creation. Traditional methods of networking, manual research, and intuition remain essential but no longer suffice in a data-saturated, fast-moving market. Artificial intelligence in private equity enables firms to process and interpret information at unprecedented scale and speed.

Through machine learning and natural language processing, AI can scan thousands of financial reports, filings, and market updates in hours, uncovering insights that human analysts might miss. Predictive analytics models identify investment opportunities, forecast portfolio performance, and detect potential risks early. AI also facilitates continuous portfolio monitoring, enabling firms to act proactively rather than react quarterly.

Ultimately, private equity AI enhances decision-making precision, minimises cognitive bias, and builds institutional intelligence. As cloud-based tools democratise access, even mid-market firms can now harness AI-driven insights once reserved for significant, technology-equipped funds, creating a lasting competitive advantage.

Key Use-Cases of AI Across the Private Equity Lifecycle

Artificial intelligence and data analytics in private equity are transforming every stage of the investment lifecycle, from deal origination to exit execution. Instead of relying solely on intuition or manual research, AI enables data-driven precision, scalability, and speed, redefining how firms operate and compete.

Deal Sourcing & Origination

AI-powered platforms analyse millions of data points from funding rounds and leadership changes to web traffic and sentiment analysis to identify high-potential acquisition targets before they surface publicly. Machine learning models rank companies based on historical investment success, improving both the quality and efficiency of deal flow.

Due Diligence

AI automates document analysis, contract reviews, and financial audits. Natural language processing (NLP) identifies red flags in agreements, while predictive analytics verifies growth claims using alternative data sources such as transactions or hiring trends, reducing both bias and oversight.

Value Creation & Portfolio Monitoring

After acquisition, AI and machine learning in private equity support real-time performance tracking through automated dashboards. Advanced predictive analytics methods optimise pricing, forecast demand, and detect churn risks, helping operating partners act proactively instead of reactively.

Exit Planning & Execution

AI models determine the best exit timing by analysing market trends, competitor movements, and investor sentiment. Automated content generation accelerates the creation of investment memorandums and reports, streamlining execution.

Predictive Valuation & Risk Management

AI-enhanced valuation models use macroeconomic indicators, industry data, and probabilistic forecasting to more accurately assess downside risk and upside potential. Compliance tools continuously scan for anomalies, regulatory shifts, or ESG risks across the portfolio.

Investor Reporting & Relationship Management

AI automates personalized investor updates, integrates data from multiple systems, and uses chatbots to manage LP interactions, enhancing transparency, efficiency, and trust across the investment ecosystem.

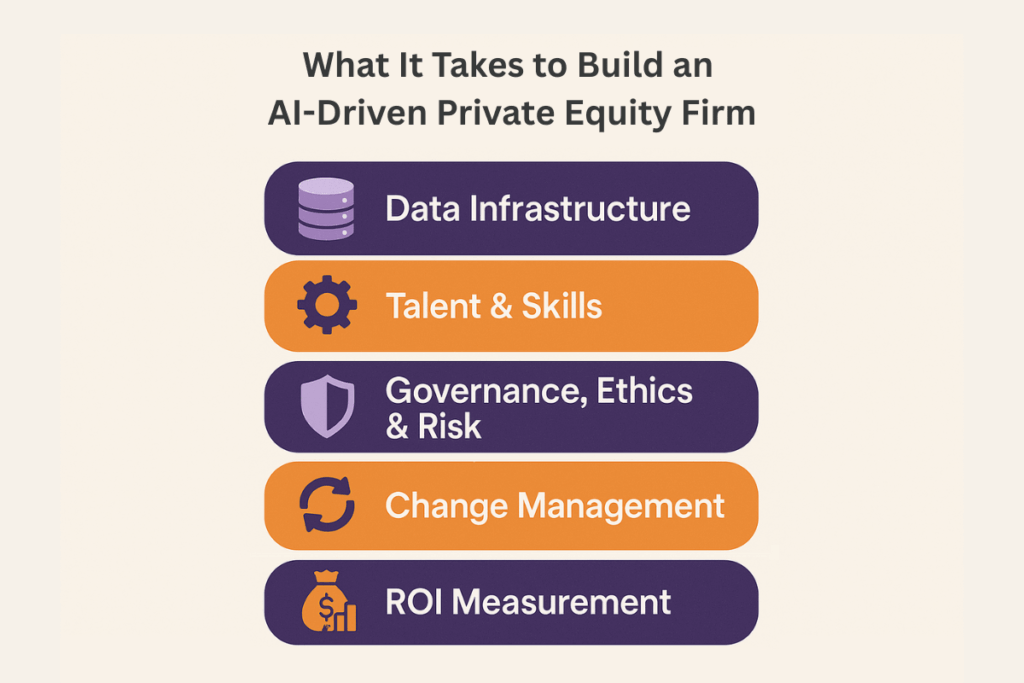

Technical & Organizational Foundations for AI in Private Equity

Successfully adopting AI in private equity requires much more than technology investment it demands a strong foundation built on robust data infrastructure, skilled talent, ethical governance, effective change management, and measurable ROI tracking. Together, these pillars ensure that artificial intelligence drives sustainable value across the private equity lifecycle.

Data Infrastructure

AI and machine learning in private equity depend on high-quality, unified data. Firms must consolidate fragmented data from CRMs, ERPs, accounting software, and spreadsheets into centralized warehouses.

Tools powered by AI based data extraction can automate the process of collecting and cleaning unstructured information, ensuring faster and more accurate integration. Establishing real-time pipelines, API integrations, and master data management ensures accuracy, consistency, and accessibility.

Cybersecurity, encryption, and role-based access controls are vital to protecting sensitive financial and operational data. Cloud platforms offer scalability but require attention to compliance and data residency laws.

Talent & Skills

Implementing AI for private equity requires multidisciplinary teams of data scientists, ML engineers, and financial analysts trained in analytics. PE firms also need to upskill deal teams and portfolio managers to interpret AI insights and integrate them into decision-making. Building an internal culture of data literacy helps bridge the gap between traditional investment intuition and data-driven strategy.

Governance, Ethics & Risk

Responsible AI adoption requires governance frameworks to ensure model transparency, accuracy, and fairness. Private equity AI models must be routinely tested for bias, explainability, and compliance with data privacy laws like GDPR. Ethical oversight is critical when AI impacts workforce decisions within portfolio companies.

Change Management

Transitioning to AI-driven operations often faces cultural resistance. Clear communication, pilot projects, and early success stories help demonstrate tangible value. Training programs and incentives aligned with data-driven performance further ease adoption.

ROI Measurement

Quantifying the impact of AI in private equity involves tracking metrics such as deal-flow efficiency, due diligence speed, portfolio growth, and exit performance. By establishing baselines and measuring improvements, firms can link AI investments directly to enhanced returns and operational efficiency.

Strategic Implications of AI in Private Equity

The integration of AI into private equity is reshaping competitive dynamics, investment strategies, and value-creation models across the industry. Beyond improving efficiency, artificial intelligence in private equity now defines how firms differentiate themselves, attract capital, and sustain long-term growth.

AI as a Differentiator

Firms that embed AI and data in private equity gain a distinct edge in identifying undervalued opportunities faster, conducting more rigorous due diligence, and optimising portfolio performance with predictive insights. This technological sophistication not only appeals to limited partners seeking innovation but also attracts top-tier investment professionals and portfolio executives who value data-driven decision-making.

Market Impact & Risk of Inaction

As AI accelerates deal sourcing and valuation accuracy, firms without AI for private equity face diminishing competitiveness. Delayed adoption leads to slower deal flow, overlooked risks, and weaker portfolio outcomes. Meanwhile, early adopters refine algorithms and strengthen data moats, widening the performance gap. Inaction risks becoming a long-term strategic disadvantage.

Sector & Strategy Nuances

AI’s impact varies across strategies. Growth equity relies on machine learning for market prediction, industrial buyouts use AI to boost operational efficiency, and healthcare PE applies it to clinical and regulatory data. Ultimately, success depends on combining sector expertise with intelligent, AI-driven insights to sustain market leadership.

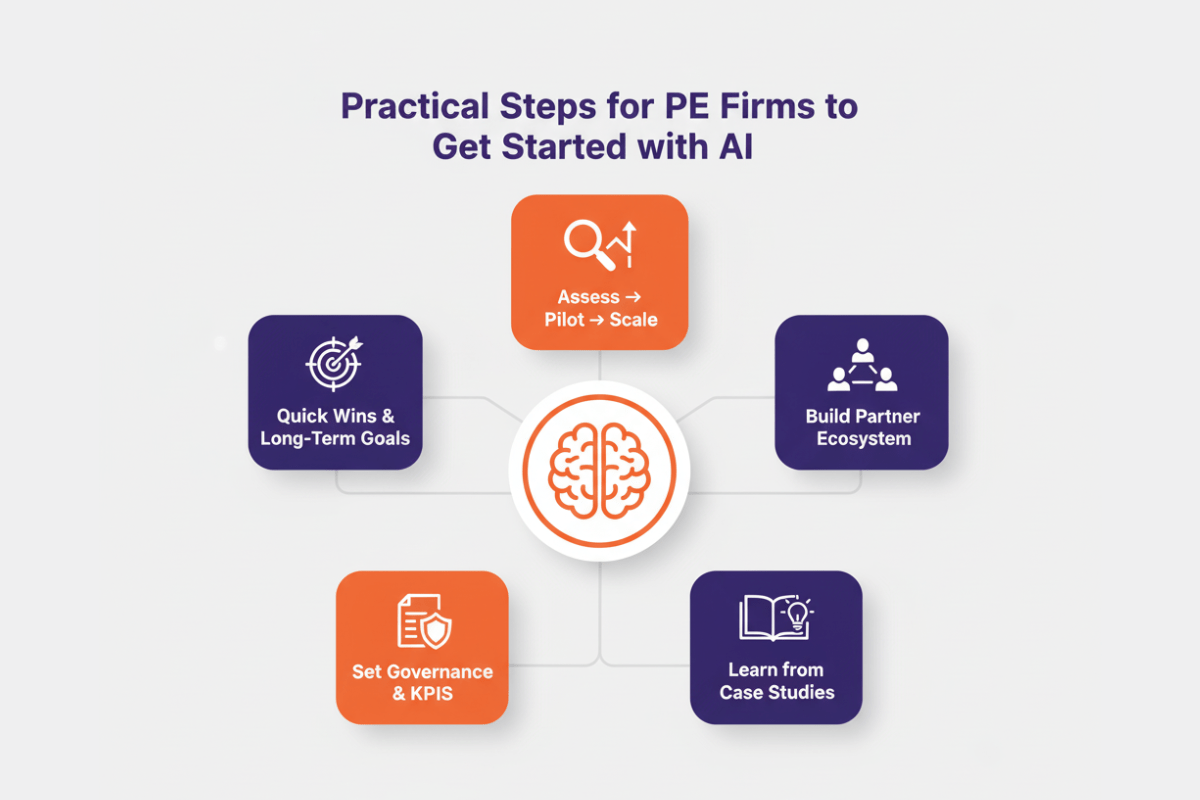

Practical Steps for PE Firms to Get Started

Private equity firms ready to embrace artificial intelligence can follow a structured approach that balances quick wins with long-term capability building. The key is to demonstrate measurable value early while laying the groundwork for sustained competitive advantage.

Quick Wins vs. Long-Term Initiatives

Starting with focused, high-impact use cases builds internal credibility and momentum. Tools that automate deal pipeline management, such as AI-assisted target screening and preliminary analysis, deliver visible efficiency gains within weeks and require minimal data infrastructure.

Similarly, AI driven enterprise search and email analysis systems can extract market intelligence from daily communications and internal repositories, offering immediate insights while teams develop advanced analytical capabilities.

Other quick wins include portfolio monitoring dashboards that unify existing data sources to enhance visibility and automated LP reporting that reduces administrative effort, freeing time for strategic tasks.

In contrast, long-term initiatives, such as predictive valuation models and AI-driven due diligence, require deeper data consolidation, model training, and validation. These projects may span quarters or years, but establish durable competitive advantages. Balancing early wins with strategic initiatives ensures ongoing organisational support while driving transformation.

Roadmap: Assess → Pilot → Scale

- Assess: Begin by cataloguing current data assets, technology systems, and analytical competencies. Identify pain points and rank opportunities based on potential impact and implementation complexity. Gather input from investment and operations teams to uncover workflow bottlenecks.

- Pilot: Launch small-scale pilot projects with defined success metrics and limited scope. Select sponsors open to iteration and develop minimum viable products (MVPs) to test feasibility within 3–6 months. Evaluate outcomes objectively before scaling.

- Scale: Expand successful pilots by improving data integration, refining models, and embedding insights into decision workflows. Establish a Centre of Excellence (CoE) to standardise best practices, foster knowledge sharing, and align investments across deal teams.

Building a Partner Ecosystem

Few PE firms have the internal resources to manage every aspect of AI implementation. When selecting vendors, evaluate product roadmaps, integration potential, and data portability to avoid over-dependence and maintain flexibility. Forming strategic partnerships accelerates capability development:

- Technology vendors provide pre-built AI models tailored for private equity workflows.

- Consultants offer specialised expertise in implementation, governance, and change management.

- Academic collaborations open access to cutting-edge research and skilled data talent.

- Portfolio partnerships allow testing of AI applications in real-world contexts.

Governance & KPI Framework

Establish a cross-functional AI Steering Committee comprising investment, operations, and technology leaders to oversee strategy, risk, and prioritisation. Alongside this, develop a clear data governance roadmap to guide how data is collected, validated, and used across AI initiatives.

Define decision rights around model deployment and AI-influenced investment decisions to ensure accountability.

Regular reviews help reallocate resources toward high-value initiatives and refine strategy based on insights and lessons learned. Key performance indicators (KPIs) should measure both adoption and business impact:

- Operational metrics: Model accuracy, user satisfaction, time savings.

- Financial metrics: Improved deal quality, faster closures, enhanced portfolio performance, and fund-level ROI.

Real-World Case Examples

- Healthcare: A mid-market PE firm used NLP to analyse clinical trial databases, identifying undervalued drug candidates. Within 18 months, this approach drove three acquisitions outperforming traditional deals by 15%.

- Growth Equity: A firm leveraged ML models to predict SaaS churn rates more accurately than seller estimates, uncovering inflated valuations and saving 20% versus winning bids.

- Industrial: A PE fund applied computer vision across portfolio facilities, identifying maintenance and layout inefficiencies that increased production efficiency by 12%.

From readiness assessments to full-scale deployments, we help firms like yours adopt AI confidently and effectively.

AI Adoption Success Stories in the Private Equity Industry

The success of artificial intelligence in private equity is best illustrated through real-world implementations by leading global firms. These examples showcase how AI, data analytics, and automation are transforming deal sourcing, valuation, portfolio monitoring, and investor engagement across the industry.

Blackstone – AI for Deal Sourcing & Portfolio Intelligence

Blackstone developed a proprietary AI-driven investment platform that processes massive datasets to identify early-stage opportunities and monitor portfolio performance. Using machine learning and natural language processing (NLP), the system analyses alternative data sources such as news feeds, social media activity, and web traffic to detect companies approaching key inflexion points before formal sale processes begin.

For portfolio management, AI tracks over 200 KPIs across holdings, flagging anomalies and surfacing best practices for replication. Predictive models anticipate operational or financial shifts, allowing proactive intervention. With over 350 data scientists and technologists, Blackstone treats AI as a core competitive differentiator, not just a support tool.

KKR – Data Science-Driven Value Creation

KKR’s dedicated analytics division, KKR Insights, partners with portfolio companies to embed AI into operations. Its machine learning models and AI demand forecasting tools optimize pricing, demand prediction, and supply chain management.

One standout project used computer vision and NLP to evaluate customer feedback across 500+ retail outlets, uncovering granular issues that traditional surveys missed. Implementing data-driven recommendations increased same-store sales by 8% within six months.

By integrating data science into its value-creation strategy, KKR positions analytics as a deal-winning differentiator, giving portfolio CEOs access to enterprise-grade AI capabilities.

Carlyle Group – Automated Due Diligence & Risk Analysis

The Carlyle Group employs AI and data engineering to automate due diligence and strengthen risk management. NLP algorithms review thousands of contracts to flag change-of-control clauses or hidden liabilities, while machine learning evaluates financial data to spot irregularities and assess revenue quality.

Carlyle’s AI-powered risk monitoring system scans its portfolio for cybersecurity threats, regulatory changes, and geopolitical risks, issuing real-time alerts for early intervention. Notably, the system uncovered critical issues in 15% of deals that traditional diligence would have missed, preventing costly underperforming investments.

Bain Capital – Predictive Valuation & Financial Forecasting

Bain Capital leverages predictive machine learning models to improve valuation accuracy and investment decision-making. These models incorporate thousands of data points beyond standard DCF inputs to forecast growth, margins, and capital requirements under multiple scenarios.

AI-driven insights inform valuation ranges, identify performance drivers, and align management teams with investors on strategic priorities. By integrating predictive analytics into exit planning, Bain improved its market timing and capital allocation decisions, achieving better fund-level returns.

Apollo Global Management – AI-Enhanced Investor Reporting

Apollo Global Management implemented AI-powered investor reporting tools that use natural language generation (NLG) to produce tailored LP updates with performance summaries, market insights, and personalised narratives.

This automation reduced reporting time by 70% while improving precision and consistency. A built-in AI chatbot now manages routine investor inquiries, offering 24/7 transparency and responsiveness. The system allows Apollo’s investor relations teams to focus on relationship-building and proactive communication, enhancing LP trust and engagement.

The Responsible Use of AI in Private Equity: Risks and Limitations

As artificial intelligence reshapes private equity, firms must recognise that its power comes with risks. Responsible AI adoption ensures innovation strengthens, not undermines, investment performance, compliance, and trust.

AI Hype vs. Real Value

The hype surrounding AI often overshadows its true potential. Many “AI-powered” tools deliver little beyond automation or basic analytics. For private equity firms, distinguishing real AI value from marketing buzz is critical.

Real innovation comes from focused use cases such as applications of AI in customer analytics, which reveal actionable insights that traditional data methods often miss.

Overreliance on algorithms without human oversight can lead to blind spots, especially when market conditions shift unexpectedly. The pandemic proved that models trained on historical data can fail when confronted with new realities.

Firms should rigorously test AI solutions, set realistic expectations, and ensure every system complements, not replaces, human judgment.

Data & Model Risks

AI in private equity is only as strong as the data behind it. Biased, incomplete, or outdated datasets lead to flawed insights and poor investment outcomes.

Overfitting and limited training data can cause inaccurate forecasts across industries. Firms must prioritise data integrity, continuous model validation, and transparency in algorithmic decision-making.

Emerging risks such as adversarial manipulation and data gaming further underscore the need for human review and robust governance.

Regulatory & Compliance Gaps

AI regulation remains fragmented, with evolving frameworks such as the EU AI Act and regional data privacy laws. Private equity firms must align AI operations with these standards to avoid compliance breaches. Transparent documentation, audit trails, and collaboration between legal and technical teams mitigate regulatory risks.

Human–AI Balance

The future of private equity lies in human–AI collaboration. AI accelerates analysis and efficiency, but human expertise provides strategic, relational, and ethical judgment. Striking this balance ensures technology enhances rather than replaces the art of investing.

Top AI Tools & Solutions for Private Equity Operations

The rapid evolution of AI in private equity has led to an ecosystem of specialised platforms that streamline every stage of the investment lifecycle from deal sourcing to investor reporting. By leveraging the right AI tools, firms can enhance efficiency, reduce human error, and uncover opportunities invisible to traditional analysis.

Deal Sourcing & Origination Tools

Platforms like Affinity, CB Insights, and Sourcescrub are redefining deal origination. Affinity applies relationship intelligence to map introductions and strengthen connections within CRM systems. CB Insights uses machine learning and natural language processing to identify high-growth startups. At the same time, Sourcescrub tracks digital signals like hiring trends and funding patterns to spot emerging investment opportunities early.

Due Diligence Tools

AI-driven tools such as Kira Systems, Luminance, and AlphaSense accelerate due diligence by automating contract analysis and extracting key legal and financial insights from vast document sets. These tools help private equity teams uncover red flags and efficiently benchmark targets.

Analytics & Valuation Platforms

Preqin, Arkera, and Daloopa integrate alternative data, benchmarking, and predictive analytics to enhance valuation accuracy and validate growth assumptions. Their machine learning models improve financial modelling and deal assessment with precision and speed.

Many firms also partner with AI-powered private equity analytics consulting providers to customise these insights for specific deal strategies and portfolio objectives.

Value Creation & Portfolio Optimisation

Post-acquisition, platforms like Tableau, Anaplan, and Celonis empower firms with real-time portfolio monitoring, predictive forecasting, and operational optimisation, helping maximise portfolio value.

Reporting & Investor Relations Tools

Solutions like eFront, iCapital, and Backstop Solutions streamline investor reporting, automate performance updates, and personalise communications using AI-powered insights enhancing transparency and strengthening LP relationships.

We help firms cut through tool complexity & design a unified AI ecosystem that enhances efficiency, accuracy, & deal outcomes.

The Future of AI in Private Equity: Key Trends and Outlook

The future of AI in private equity is being defined by rapid innovation, greater accessibility, and evolving operating models. As artificial intelligence matures, it is transforming how firms source deals, conduct due diligence, optimize portfolios, and communicate with investors.

Rise of Generative AI & Autonomous Agents

The next frontier lies in generative AI and autonomous agents, which enable natural language interactions and intelligent automation. Tools like GPT-4 can draft investment memos, analyse performance data, and create personalised investor communications.

As the implementation of generative AI accelerates, autonomous AI assistants may manage multi-step workflows—from identifying targets to conducting preliminary due diligence—enhancing productivity and precision.

Scaled AI Adoption & Tech Convergence

Previously limited to significant funds, scalable cloud platforms are democratizing AI-driven analytics for mid-market firms. Integration with blockchain, IoT, and cloud computing will enable seamless data sharing, predictive insights, and real-time monitoring across portfolio companies.

Evolving Operating Models

As AI-driven decision-making becomes central to operations, firms are reorganising around data collaboration and automation. Investment professionals will increasingly partner with AI systems, while portfolio companies leverage analytics for performance optimisation. Ultimately, firms that embrace this convergence of technology and human intelligence will define the next generation of competitive advantage in private equity.

FAQs

What is the role of artificial intelligence in private equity firms?

AI helps PE firms identify investment opportunities, conduct faster due diligence, monitor portfolio performance, optimise operations, and improve exit timing. It augments human judgment with data-driven insights across the investment lifecycle.

How is AI transforming the private equity investment lifecycle?

AI accelerates deal sourcing through automated screening, enhances due diligence via contract and financial analysis, enables continuous portfolio monitoring, optimises value creation at holdings, and improves exit planning through predictive timing models.

What are the top use cases of AI in private equity deal sourcing and due diligence?

Deal sourcing uses AI for target identification, relationship mapping, and competitive intelligence. Due diligence applies AI to contract review, financial analysis, fraud detection, market validation, and operational assessment through alternative data.

How do private equity firms use machine learning for portfolio optimisation?

Machine learning predicts customer churn, optimises pricing, forecasts demand, improves supply chain efficiency, identifies cost reductions, and recommends operational best practices based on performance across multiple portfolio companies.

Can AI improve the accuracy of financial modelling and valuation in PE?

Yes. AI models incorporate more variables, generate probabilistic forecasts, adapt as conditions change, and identify patterns humans miss. However, models require quality data and human oversight to avoid misleading results.

How does predictive analytics help private equity investors identify high-potential deals?

Predictive analytics processes alternative data to detect inflexion points, growth acceleration, market share gains, and operational improvements before they appear in financial statements. This early detection enables proactive outreach to targets.

What are the benefits of using AI for portfolio monitoring and value creation?

AI enables real-time monitoring versus quarterly reviews, automates performance tracking across hundreds of metrics, provides early warning of problems, identifies improvement opportunities, and facilitates benchmarking across holdings.

How is generative AI changing deal origination and due diligence in private equity?

Generative AI automates memo creation, summarises due diligence findings, translates technical analysis into plain language, generates questions for management meetings, and drafts stakeholder communications. Natural language interfaces make analytics accessible to non-technical users.

What are the main challenges of implementing AI in private equity operations?

Key challenges include data quality and consolidation, talent acquisition, organizational change management, validating model accuracy, maintaining human oversight, navigating evolving regulations, and demonstrating return on technology investments.

How do AI tools ensure data privacy and compliance in PE transactions?

AI platforms implement encryption, role-based access controls, audit trails, and data anonymisation. Firms establish governance frameworks defining acceptable use, maintain documentation of AI decisions, and conduct regular compliance audits.

What are the risks or ethical concerns of AI in private equity decision-making?

Risks include algorithmic bias leading to discrimination, over-reliance on automated systems without human judgment, data privacy violations, model errors due to poor data quality, lack of transparency, and potential market manipulation through information asymmetries.

How can private equity firms start building an AI strategy or roadmap?

Begin with capability assessment and pain-point identification, prioritise high-impact use cases, launch measurable pilots, build data infrastructure, develop or acquire talent, establish governance, and scale successful pilots systematically.

Conclusion

Artificial intelligence has shifted from experimental curiosity to operational necessity in private equity. Firms building genuine AI capabilities create sustainable competitive advantages in deal sourcing, due diligence, and value creation. The technology won’t replace human judgment but will amplify the capabilities of professionals who learn to work effectively with intelligent systems.

Starting with focused pilots while building long-term capabilities positions firms to thrive as AI reshapes competitive dynamics across private markets.

Luckily, Folio3 Data Services empowers private equity firms with customised AI and analytics solutions that enhance deal sourcing, manage due diligence, and unlock portfolio value through actionable, data-driven insights.