Customer retention has become a make-or-break challenge for modern businesses. According to Harvard Business Review, acquiring a new customer costs five to 25 times more than retaining an existing one. Yet companies across industries face the same problem: customers leave without warning. This is where customer churn prediction comes in. It uses data and machine learning to identify which customers are likely to leave before they actually do.

Research from Bain & Company shows that increasing customer retention rates by just 5% can boost profits by 25% to 95%. This guide walks you through everything you need to know about churn prediction, from understanding the models to implementing them in your business. You’ll learn practical steps, industry use cases, tools, and best practices that help you keep customers engaged and loyal.

What is Customer Churn Prediction?

Customer churn prediction analyzes historical data and behavioral patterns to identify which customers will likely discontinue service. Rather than responding to cancellations after they happen, businesses receive advance warnings through pattern recognition. The system examines factors including transaction frequency, customer service contacts, and platform engagement to generate churn probability scores. While traditional approaches examine past departures, predictive analytics identify future risks by detecting warning signals as they emerge.

Machine learning algorithms study historical churn cases and uncover patterns that escape manual detection. Businesses apply these probability scores to focus retention resources, launching customized campaigns and direct outreach toward vulnerable accounts. Some assume churn prediction delivers certain outcomes, but it actually produces probability assessments that guide strategic choices. The objective is enhanced decision-making rather than flawless prediction of customer actions.

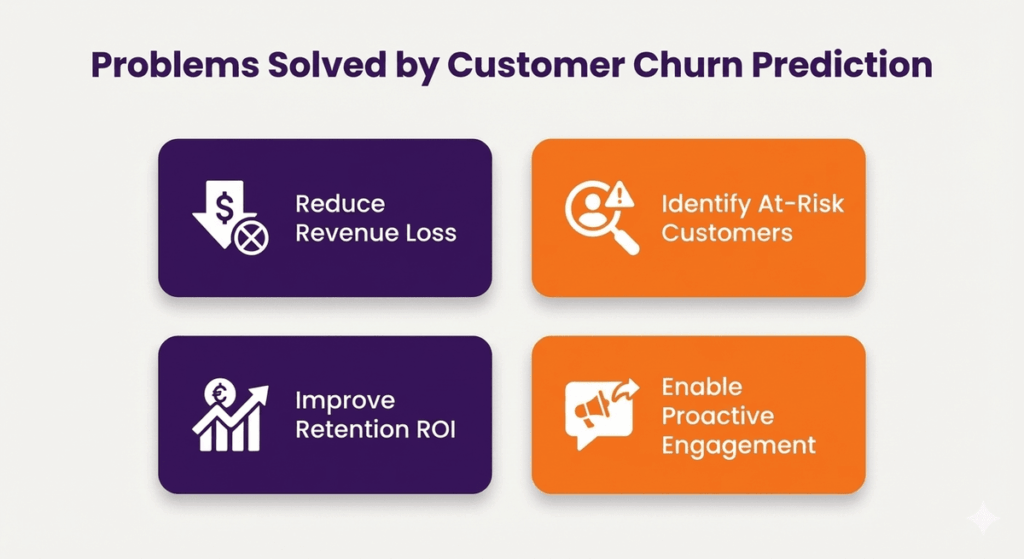

What Problems Customer Churn Prediction Solves

Businesses lose customers daily, but most don’t know who’s at risk until it’s too late. Churn prediction transforms this guessing game into a data-driven strategy. The applications of predictive customer analytics allow companies to identify at-risk customers, optimize retention efforts, and protect revenue streams before cancellations occur.

Reduce Revenue Loss

Every churned customer represents lost monthly recurring revenue. Prediction models help you intervene before cancellation, protecting your revenue stream. Companies can calculate potential savings by multiplying average customer value by preventing churns.

Identify At-Risk Customers Early

Early detection gives your team time to act. Models flag declining engagement weeks or months before actual churn. This advance notice lets you design personalized retention campaigns that address specific customer concerns.

Improve Retention ROI

Without prediction, companies waste retention budgets on happy customers who won’t leave. Churn models target resources where they matter most. This precision turns retention from a cost center into a profit driver.

Enable Proactive Engagement

Prediction shifts your team from firefighting to prevention. Customer success teams reach out before problems escalate. This proactive approach strengthens relationships and demonstrates that you value their business beyond transactions.

Why Customer Churn Prediction Is Critical for Business Growth

Understanding churn prediction isn’t just about keeping customers. It fundamentally changes how you allocate resources and plan for growth across your entire organization.

1. Cost of Customer Acquisition vs Retention

Marketing teams spend heavily to acquire new customers through ads, content, and campaigns. Retention requires far less investment per customer. The math is simple: keeping existing customers profitable beats constantly replacing them.

2. Churn Impact on Revenue

High churn rates create a leaking bucket problem. You pour resources into acquisition while revenue flows out the bottom. Even strong sales teams can’t outpace significant churn without eventually hitting a growth ceiling.

3. Improve Retention Strategies

Churn prediction reveals why customers leave. Maybe it’s poor onboarding, missing features, or pricing concerns. These insights let you fix root causes instead of treating symptoms with generic retention tactics.

4. Retention Benefits with Data

Frederick Reichheld of Bain & Company research demonstrates that companies with high retention grow faster than competitors. Loyal customers buy more over time, refer others, and provide valuable feedback that drives product development.

How Customer Churn Prediction Models Work

Machine learning powers modern churn prediction. Several algorithms can predict customer behavior, each with specific strengths for different business scenarios and data types. Using advanced predictive analytics techniques, companies can combine models like random forests, gradient boosting, and neural networks to improve accuracy and uncover subtle churn patterns that simpler methods might miss.

1. Logistic Regression

This statistical method calculates the probability of a binary outcome: churn or no churn. It works well when you need transparency in decision-making. Business teams can easily understand which factors most influence predictions.

2. Decision Trees

Decision trees split customers into groups based on behavior thresholds. They create visual rules that mimic human decision-making. This makes them excellent for explaining predictions to non-technical stakeholders.

3. Random Forest

Random forest combines hundreds of decision trees to improve accuracy. Each tree votes on the prediction, and the majority wins. This ensemble approach reduces errors and handles complex customer data patterns.

4. Gradient Boosting (XGBoost, LightGBM)

Gradient boosting builds models sequentially, with each new model correcting previous mistakes. XGBoost and LightGBM are industry favorites because they deliver high accuracy on structured data like customer records and transaction histories.

5. Neural Networks

Deep learning models can process massive datasets and capture subtle patterns. They excel with unstructured data like customer support chat logs or email content. However, they require more data and computing power than other methods.

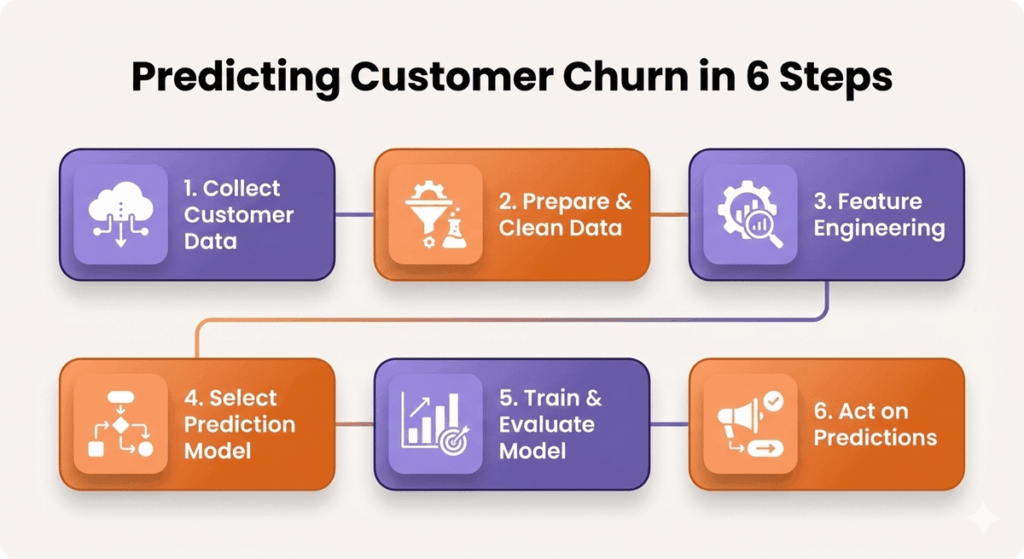

How to Predict Customer Churn in 6 Steps

Developing a functional churn prediction system demands a methodical process. These six steps move you from unprocessed data to practical insights your teams can implement.

Step 1: Collect Relevant Customer Data

Begin by aggregating data across every customer interaction point. Extract records from CRM platforms, payment systems, product usage tools, and service requests. Capture demographic information, purchase records, activity measurements, and interaction histories for comprehensive customer profiles.

Step 2: Prepare and Clean the Data

Unprocessed data includes inconsistencies, redundancies, and incomplete entries. Identify and resolve these problems prior to analysis. Unify data structures, address anomalies, and maintain uniformity between disparate sources to strengthen model performance.

Step 3: Perform Feature Engineering

Convert basic data into predictive indicators. Generate measurements such as time elapsed since last transaction, mean purchase amount, or service inquiry rate. Develop additional variables that reflect behavioral shifts across timeframes.

Step 4: Select the Right Churn Prediction Model

Pick algorithms according to dataset volume, intricacy, and transparency requirements. Begin with straightforward logistic regression, then evaluate ensemble techniques like random forest. Assess effectiveness through measures including accuracy and precision.

Step 5: Train, Validate, and Evaluate the Model

Divide your dataset into training and validation subsets. Build the model using past churner and retention data. Test projections against new data to confirm the model performs beyond initial training parameters.

Step 6: Take Action Based on Predictions

Implement the model for ongoing customer risk assessment. Distribute at-risk customer rosters to retention specialists. Create intervention approaches informed by churn factors discovered through model examination.

From data collection to predictive modeling, Folio3 supports your team in building accurate churn prediction systems that drive measurable business results.

Key Data & Features Used in Customer Churn Prediction

The quality of your predictions depends directly on the data you feed your models. These features consistently prove most valuable across industries and business models.

1. Behavioral Data

Track how customers interact with your product or service. Login frequency, feature usage, and navigation patterns reveal engagement levels. Sudden changes in behavior often signal dissatisfaction before formal complaints arise.

2. Usage Frequency

Measure how often customers use your core features. Declining usage is one of the strongest churn indicators. Compare current activity to each customer’s historical baseline to spot concerning trends.

3. Support Tickets

Interactions with support teams provide rich signals. Track ticket volume, resolution time, and sentiment using customer service analytics to identify patterns that indicate potential churn. Multiple unresolved issues or escalations strongly correlate with future churn across all industries.

4. Payment History

Failed payments, late renewals, or downgrade requests indicate financial friction. Monitor billing issues closely since payment problems often precede cancellation. Early intervention can save relationships affected by simple billing errors.

5. Engagement Metrics

Email open rates, feature adoption, and community participation measure overall engagement. Customers who stop engaging with your content or community typically churn within weeks. These soft signals complement hard usage data.

Industry-Specific Customer Churn Prediction Use Cases

Different industries face unique churn challenges. Understanding sector-specific patterns helps you build more accurate models and design better retention strategies for your market.

1. SaaS Churn Prediction

Software companies track seat utilization, feature adoption, and integration depth. Users who don’t complete onboarding or integrate with existing tools churn quickly. Predicting churn helps customer success teams prioritize onboarding and training resources.

2. Telecom Churn Prediction

Phone and internet providers analyze call volumes, data usage, and customer service contacts. Contract end dates combined with competitor promotions create high-risk periods. Prediction models help timing retention offers before customers shop around.

3. Banking & Financial Services

Banks monitor transaction frequency, account balances, and product usage across checking, savings, and credit cards. Customers who reduce their banking activity or consolidate accounts elsewhere show clear churn signals. Early detection enables relationship managers to engage personally.

4. eCommerce & Retail

Online retailers use predictive analytics in the retail industry to track purchase frequency, cart abandonment, and browse behavior. Customers who stop visiting or reduce order values need re-engagement campaigns. Prediction models identify when someone transitions from active buyer to lost customer.

Customer Churn Prediction Tools & Platforms

You don’t need to build everything from scratch. Many platforms provide ready-made capabilities for churn prediction, from data visualization to full machine learning pipelines.

1. BI & Analytics Tools

Business intelligence platforms help teams visualize churn patterns and build basic predictive models without extensive coding knowledge.

Power BI

Power BI connects to multiple data sources and offers built-in machine learning features for churn prediction. Business analysts can create interactive churn dashboards and share insights across teams without writing code.

Tableau

Tableau provides strong visualization options that help teams understand churn patterns visually. It includes predictive analytics capabilities and integrates with R and Python for advanced modeling.

2. Machine Learning Platforms

Dedicated ML platforms offer enterprise-grade capabilities for building, training, and deploying sophisticated churn prediction models at scale. These platforms are particularly useful for developing big data predictive models, allowing teams to process massive datasets and uncover patterns that drive accurate churn forecasts.

Snowflake

Snowflake combines data warehousing with machine learning through Snowpark. Teams can build churn models directly where their data lives, eliminating data movement and reducing complexity.

AWS SageMaker

AWS SageMaker offers pre-built churn prediction algorithms and AutoML capabilities that simplify model building. It handles infrastructure management so data teams focus on model accuracy.

Google Vertex AI

Google Vertex AI provides managed machine learning with easy deployment options for predictions at scale. It supports both AutoML for quick starts and custom training for complex requirements.

3. Customer Data Platforms

Customer data platforms unify information from multiple touchpoints, creating the complete customer profiles needed for accurate churn prediction.

Segment

Segment unifies customer data from websites, mobile apps, and backend systems into profiles suitable for churn modeling. It eliminates data silos that prevent accurate predictions.

Salesforce

Salesforce Einstein AI includes churn prediction features directly in the CRM. Sales and customer success teams access churn scores without leaving their daily workflow.

HubSpot

HubSpot offers predictive lead scoring that extends to customer retention predictions. Marketing and sales teams can trigger automated retention campaigns based on churn risk.

Customer Churn Prediction Problems and Solutions

Implementing churn prediction isn’t always smooth. Companies face common obstacles that can derail projects. Understanding these challenges helps you prepare better solutions upfront.

1. Poor Data Quality

Missing values, duplicates, and inconsistent formats reduce model accuracy. Incomplete customer records create gaps that weaken predictions, while duplicate entries skew patterns. Inconsistent formats across different systems make it impossible for algorithms to learn reliable patterns. Addressing these issues requires data engineering expertise to build pipelines that clean, standardize, and validate data before it enters the model.

Solution: Implement data quality checks early in the pipeline. Set up automated validation rules that flag missing fields, identify duplicates, and standardize formats before data enters your model. Schedule regular audits and establish clear ownership for data accuracy across departments.

2. Imbalanced Datasets

Most customers don’t churn, creating datasets where churners are rare. Models trained on imbalanced data predict everyone stays, achieving high accuracy but zero usefulness. When 95% of customers stay loyal, a model predicting “no churn” for everyone appears accurate while providing no value.

Solution: Use techniques like SMOTE oversampling or adjust class weights during training. SMOTE creates synthetic examples of churning customers to balance your dataset, while class weights tell the algorithm to pay more attention to the minority class.

3. Model Interpretability

Complex models like neural networks work well but don’t explain why someone will churn. Stakeholders need reasons to trust and act on predictions. A black box saying “Customer X has 80% churn probability” gives retention teams no direction on what intervention might work.

Solution: Use SHAP values or LIME to explain individual predictions regardless of model complexity. These techniques show which features contributed most to the churn score, like declining login frequency or recent support tickets, guiding targeted interventions.

4. Lack of Actionability

Accurate predictions mean nothing without clear next steps. Teams receive churn scores but don’t know how to prevent it. Data scientists deliver spreadsheets of at-risk customers, but managers lack guidance on whether to offer discounts, improve onboarding, or escalate accounts.

Solution: Connect predictions to specific interventions. Build playbooks that map churn reasons to retention tactics. If the model shows engagement decline, trigger educational content. If pricing concerns emerge, route to sales for custom plans.

5. Integration with Business Systems

Predictions stuck in notebooks don’t help frontline teams. The model needs to flow into CRM, marketing automation, and customer success tools. When data scientists email weekly CSV files, predictions arrive too late and require manual distribution.

Solution: Build APIs or use integration platforms to push scores where teams already work daily. Deploy models as REST APIs that update CRM records automatically, trigger workflows in marketing platforms, or create tasks in customer success software.

From data quality to system integration, Folio3 delivers end-to-end churn prediction solutions that empower your teams to act on insights immediately.

Best Practices for Accurate Churn Prediction

Success with churn prediction requires more than just good models. Implementing analytics solutions effectively is key to turning predictions into actionable strategies. These practices separate companies that get value from those who struggle with implementation and adoption.

1. Focus on Actionable Features

Choose predictors your team can actually influence. Knowing someone will churn because they’re in a declining industry doesn’t help. Focus on controllable factors like product engagement, support quality, or feature adoption that retention efforts can improve.

2. Integrate with Retention Strategies

Build retention workflows around predictions before launching models. Define what happens when someone hits high risk. Create automated campaigns, alert customer success managers, or trigger special offers based on churn probability scores.

3. Monitor Model Performance

Models degrade over time as customer behavior changes. Track prediction accuracy monthly and retrain when performance drops. Compare predictions against actual churn to identify when the model needs updating or additional features.

4. Align Analytics with Goals

Connect churn prediction metrics to business outcomes. Track how many predicted churners you save and calculate retention ROI. This alignment helps secure ongoing investment and proves the value to leadership and skeptical teams.

Customer Churn Prediction vs Customer Churn Analysis

| Aspect | Customer Churn Prediction | Customer Churn Analysis |

| Time Focus | Forward-looking, identifies future churners | Backward-looking, examines past churners |

| Primary Goal | Prevent churn before it happens | Understand why churn occurred |

| Methods Used | Machine learning models, predictive algorithms | Descriptive statistics, cohort analysis, surveys |

| Output | Churn probability scores for active customers | Reports on churn rates and historical patterns |

| Action Timing | Proactive intervention with at-risk customers | Reactive improvements based on past learnings |

| Data Requirements | Needs behavioral, transactional, and engagement data | Primarily requires churned customer records |

| Business Impact | Directly reduces churn through early intervention | Informs long-term strategy and product decisions |

| Update Frequency | Continuous or weekly scoring | Periodic reports (monthly or quarterly) |

Future Trends in Customer Churn Prediction

Churn prediction continues evolving with new technologies. These emerging trends will shape how businesses approach retention in the coming years and decades ahead.

Agentic AI for Churn Prevention

AI agents will automatically intervene when detecting churn signals. Instead of alerting humans, these systems will trigger personalized outreach, adjust pricing, or modify service levels. The agent learns which actions work best for different customer segments.

Real-Time Churn Scoring

Batch predictions are giving way to continuous scoring. Systems will update churn probabilities instantly as customers interact with products, often using AI based data extraction to pull and process behavioral signals from multiple sources. This real-time intelligence enables immediate response to sudden behavior changes.

Predictive Personalization

Models will predict not just who will churn but which retention offer works best for each customer. Systems will test different messages, discounts, and engagement strategies automatically. Personalization moves from reactive to predictive.

AI-Driven Retention Automation

Complete retention workflows will run automatically based on predictions. From initial outreach to follow-up and escalation, AI will manage the entire process. Human teams focus only on high-value relationships requiring personal attention.

FAQs

What is a Good Churn Prediction Accuracy Rate for Businesses?

Most businesses achieve 70-85% accuracy with well-built models. Focus on precision (correctly identifying actual churners) rather than raw accuracy, since predicting everyone stays can appear accurate but provides zero value.

How Frequently Should I Retrain My Customer Churn Prediction Model?

Retrain monthly or quarterly depending on how quickly your customer behavior changes. Monitor prediction accuracy continuously and retrain when performance drops more than 5% from baseline levels.

Can Small and Medium-Sized Businesses Benefit from Churn Prediction Analytics?

Yes. Small businesses often see faster ROI because they have fewer customers to protect. Start with simple models using existing CRM data before investing in complex systems.

Which Churn Prediction Model is Most Effective for SaaS or Subscription Services?

Gradient boosting models (XGBoost, LightGBM) consistently perform best for SaaS. They handle the structured behavioral data that subscription businesses collect naturally through product analytics and billing systems.

How Does Artificial Intelligence Improve Customer Churn Prediction?

AI finds patterns humans miss in large datasets. It continuously learns from new data without manual reprogramming. Modern AI models process more variables and adapt faster than traditional statistical methods.

What Data Sources are Needed for Accurate Churn Prediction?

Combine CRM data, product usage logs, billing history, support tickets, and marketing engagement metrics. More diverse data sources improve accuracy by capturing different aspects of the customer relationship.

How Does Machine Learning Detect At-Risk Customers Before They Churn?

Machine learning identifies behavior patterns that preceded past churners. When current customers exhibit similar patterns, the model flags them as at-risk before they actually leave or cancel.

What are the Key Features or Indicators Used in Churn Prediction Models?

Usage frequency, support ticket volume, payment history, engagement metrics, feature adoption, and time since last activity are top indicators. The specific features vary by industry and business model.

How Can Predictive Analytics Reduce Customer Churn in Retail or eCommerce?

Retailers use purchase frequency, browse behavior, and cart abandonment to predict churn. Timely offers, personalized recommendations, and win-back campaigns target customers before they shop with competitors.

What is the Difference Between Churn Prediction and Churn Analysis?

Churn prediction forecasts which customers will leave in the future. Churn analysis examines why customers left in the past. Prediction enables prevention while analysis informs strategy.

How Do Random Forest and Gradient Boosting Compare for Churn Modeling?

Gradient boosting typically achieves higher accuracy but takes longer to train. Random forest is faster and easier to interpret. Test both methods and choose based on your accuracy and speed requirements.

Can Real-Time Data Improve the Effectiveness of Churn Prediction?

Real-time data enables instant response to sudden behavior changes. However, most churn signals develop over weeks or months. Focus on real-time scoring rather than real-time data collection for practical improvements.

How Do I Measure the ROI of Implementing a Churn Prediction System?

Calculate saved revenue by multiplying prevented churns by average customer lifetime value. Subtract implementation and operational costs. Most businesses see positive ROI within six months of deployment.

Conclusion

Customer churn prediction transforms retention from guesswork into a data-driven discipline. By identifying at-risk customers before they leave, businesses protect revenue, improve retention ROI, and build stronger customer relationships. The models, tools, and practices covered in this guide provide a roadmap for implementing effective churn prediction regardless of your industry or company size. Success requires quality data, appropriate algorithms, and tight integration between predictions and retention actions. Companies that master churn prediction gain a significant competitive advantage in today’s customer-centric economy.

Folio3 Data Services helps businesses implement customer churn prediction systems that drive real retention results. Our team combines deep expertise in machine learning, data engineering, and industry-specific analytics to build custom solutions on platforms like Snowflake, Databricks, and AWS. We work with companies across SaaS, healthcare, finance, and retail to turn customer data into actionable churn insights. From initial data strategy through model deployment and team training, Folio3 delivers end-to-end churn prediction solutions designed for your specific business needs and technical environment.