The financial sector generates more data than most industries, encompassing everything from transaction records and investment flows to market trends and customer behavior. Yet, raw data alone doesn’t offer clarity. What separates industry leaders from laggards is their ability to interpret data and act quickly and accurately. This is where data analytics in finance becomes indispensable.

Global financial institutions are increasingly turning to economic data analytics to make informed decisions, mitigate risks, and uncover revenue opportunities. According to a recent report by Statista, the global big data market is projected to reach $ 103 billion by 2027, with finance accounting for a significant share.

McKinsey & Company also notes that banks using analytics at scale can improve operating margins by as much as 60%. Whether it’s data analytics in finance and accounting to detect fraud, or big data analytics in finance to model economic scenarios, data-driven strategies are quickly becoming the norm, not the exception.

This blog breaks down the key benefits, use cases, and emerging trends shaping data analytics in the finance industry, explaining how businesses can leverage this data to drive results.

The Importance of Data Analytics in Finance

As finance continues to evolve in a data-saturated world, decision-makers no longer rely on gut instinct or backward-looking reports. Instead, they turn to analytics to navigate market volatility, regulatory demands, and customer expectations. Below are key areas where data analytics in finance is proving indispensable:

Informed Decision-Making in Real Time

Modern finance teams must make high-stakes decisions under pressure. A well-structured data analytics framework enables real-time insights into cash flow, asset performance, and market dynamics. With predictive models, financial institutions can forecast revenue, simulate risk scenarios, and prioritize investments based on quantified potential.

Risk Management and Compliance

Data analytics plays a critical role in identifying credit, market, and operational risks. It flags anomalies, tracks exposure across portfolios, and monitors compliance with ever-evolving regulations, such as Basel III and GDPR. This proactive approach helps institutions mitigate financial and reputational losses before they escalate.

Improving Financial Planning and Forecasting

Advanced analytics tools, including time-series analysis and machine learning, are redefining how companies approach budgeting and forecasting. These insights support strategic planning by providing accurate projections on everything from capital expenditures to revenue cycles, far beyond what spreadsheets alone can offer.

Fraud Detection and Transaction Monitoring

With billions of transactions processed daily, manual fraud detection is no longer a viable option. Financial data analytics utilizes pattern recognition and anomaly detection to identify suspicious activities in real-time. Among the key benefits of real-time analytics is the ability to reduce false positives and enable quicker response times to potential threats.

Enhancing Customer Insights in Finance

Banks and fintech companies use behavioral analytics to personalize services, predict customer churn, and offer tailored products. With support from customer analytics consulting, institutions can better understand spending habits, income fluctuations, and credit histories—ultimately building loyalty and boosting customer lifetime value.

Supporting Data-Driven Accounting

Data analytics in finance and accounting automate mundane tasks such as reconciliations, audit trails, and invoice matching. This improves accuracy, shortens closing cycles, and gives CFOs more bandwidth to focus on strategic initiatives rather than transactional tasks.

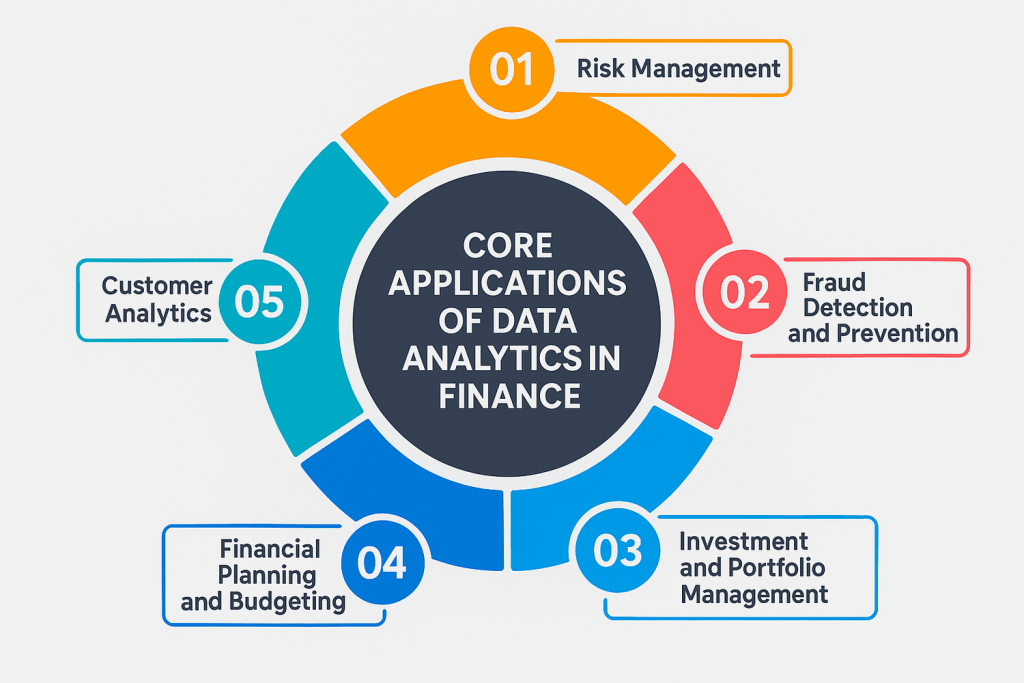

Key Applications of Data Analytics in Finance

As financial institutions grapple with rising complexity and competitive pressures, data analytics is becoming the backbone of strategic decision-making. Below are the most impactful areas where financial data analytics is being applied:

Risk Management

Effective risk management starts with data. Institutions now use big data analytics in finance to assess creditworthiness, detect market volatility, and quantify exposure across diverse asset classes. With scenario modeling and stress testing, they can make informed decisions that protect capital and ensure compliance with evolving regulations.

Fraud Detection and Prevention

Data analytics enables institutions to move beyond rule-based systems by identifying behavioral patterns that indicate potential fraudulent activity. By combining real time data collection with transaction analysis and machine learning models, financial firms can reduce false positives, respond faster to threats, and minimize fraud-related losses.

Investment and Portfolio Management

Data analytics in the finance industry enables portfolio managers to evaluate historical performance, conduct sentiment analysis, and dynamically rebalance portfolios. Whether it’s analyzing macroeconomic trends or mining alternative datasets (like social media sentiment), analytics helps generate alpha and reduce downside risk.

Financial Planning and Budgeting

By integrating structured and unstructured data, organizations can develop highly accurate forecasts and flexible budgeting strategies that support informed decision-making. Predictive models inform cash flow planning, operating expense tracking, and long-term capital allocation. These capabilities are significantly enhanced through advanced data analytics solutions, enabling CFOs and finance teams to move from static plans to agile, data-informed strategies.

Customer Analytics

Understanding customer behavior is vital in a sector driven by trust and personalization. Financial institutions use data analytics in finance and accounting to segment clients, predict churn, and tailor product offerings. By leveraging customer experience analytics, they can gain deeper insights into customer journeys and preferences, fostering higher engagement, loyalty, and profitability through a clearer understanding of needs and life stages.

From real-time dashboards to predictive modeling — we’ll help you lead with data.

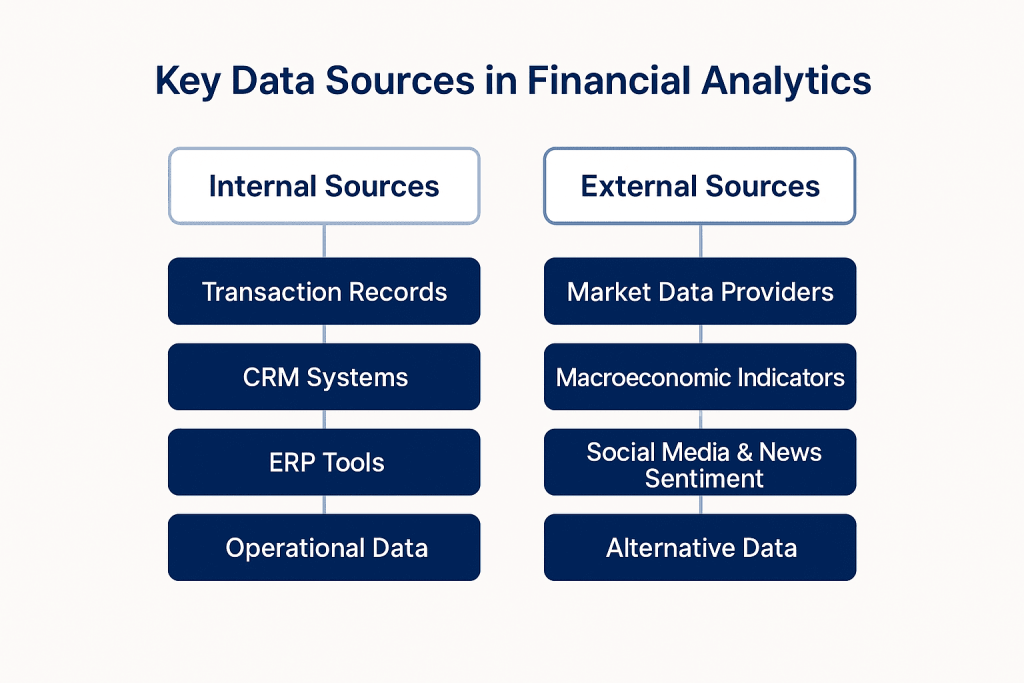

Data Sources in Financial Analytics

The strength of financial data analytics depends heavily on the quality and variety of data it draws from. Finance professionals today rely on a combination of internal and external sources to drive deeper insights and more accurate decision-making. Combining these sources supports a more comprehensive, data-driven approach to decision-making in finance and informs a more effective customer data strategy.

Internal Sources

Internal datasets are the foundation of most financial analysis. These sources are typically structured and readily accessible, forming the core of financial data analytics initiatives. These include:

- Transaction Records: Provide insights into customer spending habits, revenue patterns, and payment behaviors.

- Customer Relationship Management (CRM) Systems: Offer detailed profiles of clients, their interactions, and lifecycle value, essential for customer segmentation and targeting.

- Enterprise Resource Planning (ERP) Tools: Help track financial statements, budgets, payroll, and inventory in real time, making them indispensable for forecasting and risk analysis.

- Audit Logs & Operational Data: Useful in compliance checks and internal process optimization.

External Sources

To complement internal data, financial institutions pull from a range of third-party or publicly available datasets to gain market context:

- Market Data Providers: This includes Bloomberg, Thomson Reuters, and similar services that supply real-time stock prices, interest rates, and financial news.

- Macroeconomic Indicators: Government-released data, such as inflation rates, GDP, and unemployment statistics, help shape broader financial strategies.

- Social Media & News Sentiment: By analyzing platforms like Twitter or Reddit, institutions track market sentiment and identify potential market-moving events.

- Alternative Data: This includes satellite imagery, shipping data, and ESG scores—often utilized by hedge funds that apply predictive analytics techniques to uncover early signals and gain a competitive edge.

Features of Financial Data Analytics

Financial data analytics is more than just crunching numbers, but it’s about translating data into business foresight. Below are key features that define a well-rounded financial analytics function:

Predictive Sales Analytics

This feature uses historical sales data, customer trends, and external market indicators to forecast future revenue. Financial teams can anticipate downturns or spikes, enabling more agile budgeting and sales strategy alignment — often supported by expert data strategy services that structure and guide data use effectively.

Customer Profitability

Not all customers generate equal value. With advanced financial analytics, businesses can measure the profit contribution of each customer segment, enabling them to prioritize service levels, marketing budgets, and product offerings based on real ROI—an essential component of a well-defined data analytics strategy.

Cash Flow Analytics

Beyond traditional cash flow statements, analytics tools provide real-time visibility into working capital, receivables aging, and burn rates. This helps finance teams make informed decisions about investments, borrowing, and operational efficiency.

Value-Driven Analytics

These analytics link financial metrics to strategic KPIs, like ROIC (Return on Invested Capital) or EVA (Economic Value Added). They offer a more nuanced perspective on performance, moving beyond surface-level metrics such as revenue or gross margin.

Shareholder Value Analytics

This feature focuses on maximizing long-term shareholder returns by aligning financial strategy with market expectations. It assesses factors such as dividend policy, capital structure, and stock performance in relation to financial health.

Benefits and ROI of Data Analytics in Finance

The strategic use of data analytics in finance goes far beyond number-crunching. The data analytics benefits include improved decision-making, cost reduction, and enhanced customer experiences—all of which directly impact the bottom line and support long-term growth. Here’s how it delivers measurable value and strong returns on investment:

Improved Decision-Making

With real-time data insights and predictive models, financial teams can make faster, more informed decisions. Whether it’s evaluating investment opportunities, optimizing capital allocation, or forecasting cash flow, analytics—especially when powered by big data and predictive analytics—replaces gut feeling with data-backed accuracy.

Cost Reduction and Operational Efficiency

Financial analytics identifies inefficiencies across departments, be it excessive overhead, unnecessary vendor expenses, or outdated processes. Companies using financial analytics tools report up to 20-30% savings in operational costs, according to McKinsey & Company.

Enhanced Customer Experience

Understanding spending behavior, payment preferences, and financial needs allows firms to personalize offerings. Tailored services enhance customer satisfaction and retention, which are crucial in sectors such as retail banking, insurance, and fintech.

Competitive Advantage

Data analytics enables financial organizations to identify trends earlier, adapt to market shifts more quickly, and innovate faster than their competitors. Staying ahead of emerging data analytics trends allows these institutions to build a forward-looking business model, supported by continuous learning and refinement based on data outcomes.

Key Challenges in Financial Data Analytics

While the benefits of financial data analytics are compelling, organizations must navigate several roadblocks to extract full value from their data assets. Below are some of the most pressing challenges that financial teams face:

Data Quality and Integration Issues

Financial institutions handle massive amounts of data from various systems, including ERP platforms, CRM tools, third-party feeds, and legacy databases. Without a unified structure and standardized data formats, integrating this data becomes complex and often leads to poor-quality insights.

Many organizations turn to data integration consulting to streamline this process, ensuring that data pipelines are efficient, accurate, and aligned with business goals. Inaccurate or incomplete data can directly impact forecasting, reporting, and compliance efforts.

Regulatory and Compliance Concerns

The finance industry is heavily regulated. From Sarbanes-Oxley to Basel III and GDPR, compliance requirements vary across regions and data types. Ensuring analytics processes meet these evolving standards without compromising innovation is a balancing act that requires deep legal and technical expertise.

Partnering with experienced data engineering consultants can help financial institutions design secure, compliant data architectures and implement governance frameworks that align with regulatory mandates while supporting advanced analytics initiatives.

Data Privacy and Security

Handling sensitive financial and personal information brings serious responsibilities. Any breach or misuse of data can result in reputational damage, legal penalties, and a loss of customer trust. Implementing encryption, access controls, and audit trails is essential, but not always straightforward, especially when working with big data implementation in complex environments or cloud services.

Skill Gap and Talent Shortage

Advanced analytics requires a unique combination of domain knowledge, statistical expertise, and technical skills in tools such as Python, R, or SQL. However, the demand for skilled data professionals far exceeds the supply. According to a World Economic Forum report, data and AI skills are among the fastest-growing but hardest-to-fill roles in finance.

The Future Role of Data Analytics in the Finance Industry

As finance becomes increasingly digital and data-driven, analytics is poised to play an even more strategic role in shaping the future of the industry. Here’s how emerging technologies and priorities are redefining financial data analytics:

Integration of AI and Machine Learning

AI and machine learning are revolutionizing how financial institutions make predictions, detect anomalies, and optimize decisions. From credit scoring to algorithmic trading, these technologies automate complex tasks by learning from patterns in large datasets.

Increasingly, institutions are also exploring generative AI for data analytics to create synthetic datasets, automate reporting, and generate real-time insights with greater speed and precision.

For example, machine learning models are increasingly used in underwriting to assess creditworthiness with greater speed and accuracy than traditional models. Moreover, banks and investment firms are developing AI-driven personal finance assistants that analyze individual spending habits, suggest saving plans, and forecast financial goals, personalizing financial advice at scale.

Use of Real-Time and Streaming Analytics

The ability to act on data as it’s generated is becoming a necessity. Real-time analytics enables firms to respond instantly to market shifts, detect fraud within seconds, and continuously track key performance indicators.

Big data platforms play a critical role in supporting these capabilities by processing high-volume, high-velocity data streams efficiently.

For instance, high-frequency trading platforms now rely on streaming analytics to execute trades in microseconds based on live market data. In treasury and cash flow management, real-time analytics enable CFOs to make informed, immediate decisions regarding liquidity, funding, and exposure.

Role of Blockchain in Financial Data Analytics

Blockchain’s potential extends far beyond cryptocurrencies. In finance, it provides an immutable and transparent way to store and track transaction data. For analytics, this means improved auditability, tamper-proof records, and a single version of truth across stakeholders.

For example, blockchain can be used to trace fund transfers across borders or validate the integrity of financial statements, significantly reducing fraud risk and enhancing compliance. As more institutions adopt decentralized finance (DeFi) solutions, blockchain-powered analytics will play a pivotal role in monitoring transactions, managing risk, and ensuring transparency.

Increasing Focus on ESG (Environmental, Social, Governance) Data

Investors and regulators alike are demanding deeper insights into companies’ ESG performance. Financial institutions are utilizing data analytics to track emissions, diversity metrics, and corporate ethics in real-time, incorporating these metrics into investment models and credit scoring.

Among the growing data analytics use cases, ESG analytics is helping firms inform portfolio construction and reduce exposure to high-risk sectors.

Recent data analytics stats on global adoption highlight steady growth in ESG-related initiatives across financial markets, showing why the integration of ESG data into core financial analysis is becoming a market standard.

Discover hidden trends, improve accuracy, and enable smarter decisions.

FAQs

Why is data analytics important in the finance industry?

Data analytics enables faster, more informed decision-making by uncovering trends, patterns, and anomalies within vast financial datasets. It drives accuracy, efficiency, and strategic insights across the finance function.

How does data analytics help with risk management?

It helps identify, quantify, and predict financial risks by analyzing historical and real-time data. This enables institutions to mitigate credit, market, and operational risks proactively.

How is data analytics transforming the finance industry?

Data analytics automates manual processes, enables real-time insights, supports regulatory compliance, and empowers personalized financial services, all while reducing costs and improving outcomes.

What are the primary use cases of data analytics in finance?

Common use cases include fraud detection, customer segmentation, credit scoring, financial forecasting, portfolio optimization, and regulatory reporting.

Conclusion

The role of data analytics in finance is no longer optional, but it’s foundational. From risk management to customer personalization and ESG tracking, analytics empowers finance teams to move from reactive reporting to proactive decision-making. As financial ecosystems become increasingly complex, the ability to turn data into insight will define success.

Whether you’re a bank, fintech startup, insurance provider, or asset manager, a robust analytics strategy can elevate your business operations and long-term competitiveness. Folio3 Data Services helps finance organizations implement scalable, secure, and future-ready analytics infrastructures. From cloud data engineering to real-time dashboards and ML model deployment, we provide end-to-end solutions tailored to the finance sector.Ready to unlock the actual value of your financial data? Get in touch with Folio3 today.